Funds Disbursement: A Comprehensive Guide

Imagine having access to the necessary resources to fuel your dreams, whether it's launching a business, pursuing further education, or supporting a vital project. Accessing these resources often hinges on the process of funds disbursement, also known as "pencairan dana" in Indonesian. This comprehensive guide will delve into the intricacies of funds disbursement, providing you with the knowledge and tools to navigate this crucial process successfully.

Funds disbursement, in its simplest form, refers to the release of funds from a controlling entity to a designated recipient. This can encompass a wide array of scenarios, including loan disbursements, grant payments, investment distributions, and even payroll processing. Understanding the mechanics of this process is essential for both individuals and organizations seeking financial support.

The importance of efficient funds disbursement cannot be overstated. It ensures timely access to critical resources, enabling individuals and organizations to pursue their objectives without unnecessary delays. Furthermore, a streamlined disbursement process contributes to transparency and accountability, minimizing the risk of fraud and mismanagement.

While the specific process of funds disbursement can vary depending on the context, several key elements remain consistent. These typically include application, verification, approval, and finally, the release of funds. Each step is crucial and requires careful attention to detail to ensure a smooth and successful outcome.

Several factors can influence the efficiency of funds disbursement, including the complexity of the application process, the stringency of verification procedures, and the availability of resources. Understanding these factors can help individuals and organizations anticipate potential challenges and take proactive steps to mitigate them.

Historically, funds disbursement has evolved from manual, paper-based systems to increasingly automated digital platforms. This digital transformation has significantly improved efficiency and transparency, reducing processing times and minimizing the potential for errors. The rise of online banking and mobile payment systems has further streamlined the process, making it easier than ever for individuals and organizations to access funds.

One key challenge in funds disbursement is ensuring compliance with relevant regulations and legal frameworks. This is particularly important in contexts involving government grants or international development funding. Strict adherence to compliance requirements is essential to maintain transparency and accountability and to prevent misuse of funds.

Several best practices can enhance the efficiency and security of funds disbursement. These include implementing robust verification procedures, utilizing secure digital platforms, and establishing clear communication channels between the disbursing entity and the recipient. Regular audits and reviews can further strengthen the process and ensure compliance with relevant regulations.

Advantages and Disadvantages of Efficient Funds Disbursement

| Advantages | Disadvantages |

|---|---|

| Timely access to funds | Potential for fraud if security measures are inadequate |

| Improved transparency and accountability | Complexity of regulatory compliance |

| Reduced administrative burden | Technical challenges associated with digital platforms |

FAQs about Funds Disbursement

1. What documents are typically required for funds disbursement? This varies depending on the context, but may include application forms, identification documents, and supporting documentation for the intended use of funds.

2. How long does the disbursement process typically take? This can range from a few days to several weeks, depending on the complexity of the process and the efficiency of the disbursing entity.

3. What are the common challenges in funds disbursement? These can include delays due to incomplete documentation, stringent verification procedures, and technical issues with digital platforms.

4. How can I ensure the security of funds during disbursement? Utilizing secure digital platforms, implementing strong passwords, and regularly monitoring transactions can help mitigate security risks.

5. What recourse do I have if there are issues with the disbursement process? Contact the disbursing entity and clearly outline the problem. Escalate the issue if necessary.

6. How can technology improve funds disbursement? Automation and digital platforms can streamline the process, reduce errors, and improve transparency.

7. What are the best practices for managing disbursed funds? Maintain accurate records, track expenses diligently, and adhere to any reporting requirements stipulated by the disbursing entity.

8. What is the difference between funds disbursement and funds allocation? Funds allocation refers to the decision of how much funding will be provided, while funds disbursement is the actual release of the allocated funds.

Tips for Successful Funds Disbursement

Ensure all required documentation is complete and accurate. Maintain open communication with the disbursing entity. Be aware of deadlines and adhere to them. Utilize secure digital platforms when available. Keep meticulous records of all transactions.

In conclusion, funds disbursement (pencairan dana) is a critical process that empowers individuals and organizations to access the resources they need to achieve their goals. Understanding the nuances of this process, including its challenges and best practices, is essential for ensuring a smooth and successful outcome. By embracing technology, adhering to regulations, and prioritizing transparency, we can unlock the full potential of funds disbursement and drive positive change across various sectors. Whether you are seeking funding for a small business venture or a large-scale development project, effective funds disbursement is the key to turning visions into reality. Investing time in understanding this process will undoubtedly pay dividends in the long run. It's not merely about receiving money; it's about utilizing that capital effectively to create a positive impact. Therefore, carefully consider the strategies outlined in this guide to maximize the benefits of your funds disbursement experience.

Cara Minta Tambah Uang Pinjaman Di Pegadaian | Taqueria Autentica

7 Contoh Surat Keterangan Kerja Pentingnya Bagi Karyawan | Taqueria Autentica

Becoming More Like Christ in Your Marriage through the Sanctifying | Taqueria Autentica

pencairan dana in english | Taqueria Autentica

Adverbs Adjectives Worksheets Fast Bikes Syllable Sentences | Taqueria Autentica

Download Aplikasi Pospay Cairkan Dana BSU 2022 dari Pemerintah Rp600 | Taqueria Autentica

Dana Point Harbor Boat Parade of Lights with Dana Wharf | Taqueria Autentica

Contoh Anggaran Dana Proposal Kegiatan Contoh Proposal Pengajuan Dana | Taqueria Autentica

Contoh Surat Penarikan Dana Deposit Lazada | Taqueria Autentica

Contoh Surat Permohonan Ke Bank Bri Homecare24 | Taqueria Autentica

pencairan dana in english | Taqueria Autentica

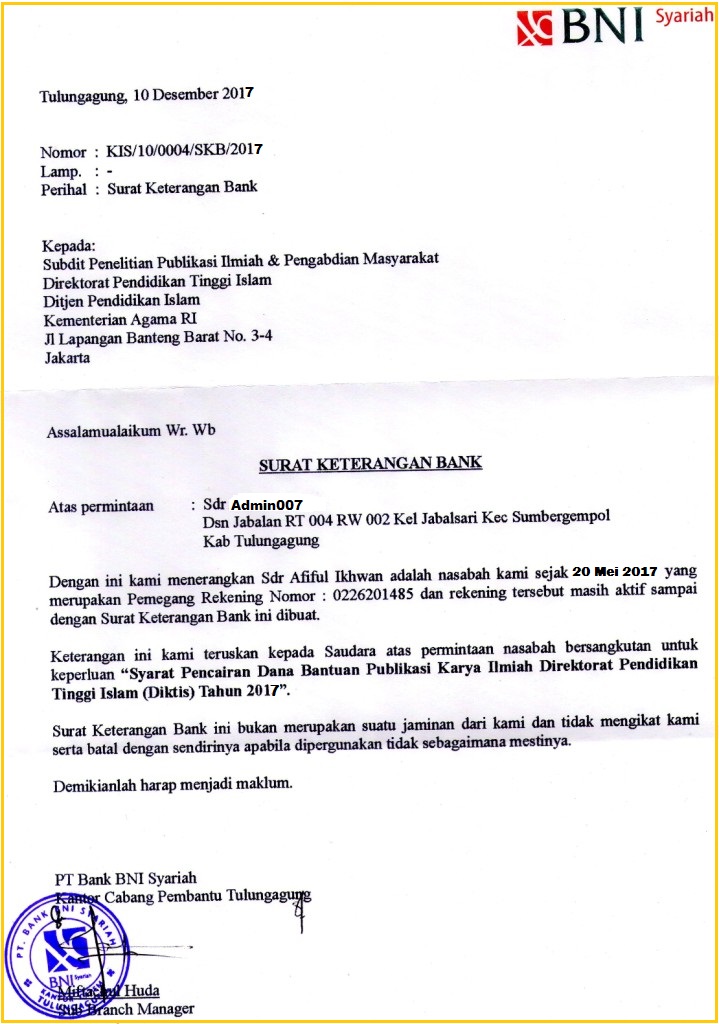

Contoh Surat Permohonan Pencairan Dana | Taqueria Autentica

Surat Pernyataan Dana Bos | Taqueria Autentica

Detail Surat Rekomendasi Pencairan Dana Ke Bank Koleksi Nomer 3 | Taqueria Autentica

Surat Dinas Cara Membuatnya Dan Contoh Surat Dinas Perusahaan | Taqueria Autentica