Bank Account Copy: Your Financial Paper Trail Decoded

Ever find yourself staring blankly at a piece of paper, wondering what the hell all those numbers and codes mean? We've all been there. Today, we're diving into the surprisingly complex world of bank account copies, or as it's known in Malay, *salinan no akaun bank*. It's more than just a piece of paper – it's a snapshot of your financial life, a record of your spending habits, and a crucial document for various financial transactions. So, buckle up, because things are about to get surprisingly interesting.

Think of your bank account copy, that *salinan no akaun bank*, as a financial diary. Every deposit, withdrawal, and transaction is meticulously documented, creating a detailed narrative of your money's adventures. Whether you're applying for a loan, proving your income, or simply tracking your spending, this document is your go-to source. But it's not just about numbers; it's about security, responsibility, and understanding the flow of your finances.

The concept of a bank statement, a printed *salinan no akaun bank*, has evolved alongside banking itself. From handwritten ledgers to digital statements, the core function remains the same: to provide account holders with a record of their transactions. In today's digital age, online banking offers instant access to these records, but the importance of a physical or downloaded *salinan no akaun bank* still holds strong. It serves as a tangible backup and can be crucial in situations where digital access is limited or compromised.

Why is this seemingly mundane document so important? Well, imagine trying to rent an apartment, apply for a visa, or even dispute a fraudulent transaction without a *salinan no akaun bank*. It’s your proof, your verification, your financial ID card. It’s the difference between a smooth process and a bureaucratic nightmare. This unassuming piece of paper holds significant weight in the financial world, so understanding its value is key.

However, with this importance comes responsibility. Protecting your bank account details, including your *salinan no akaun bank*, is paramount. Identity theft, fraud, and other financial crimes are real threats, and a misplaced bank statement can be a goldmine for malicious actors. So, treat your *salinan no akaun bank* with the same care you would your passport or credit card. Secure it, shred it when no longer needed, and be mindful of who you share it with.

One crucial element of a bank account statement is the account number itself. The account number is a unique identifier, allowing banks to accurately process transactions. It's the key to your financial castle, so safeguarding it is essential. Never share your account number with untrusted sources or in unsecured environments.

Obtaining a copy of your bank account statement, your *salinan no akaun bank*, is typically straightforward. Most banks offer online access, allowing you to download and print statements on demand. You can also visit a branch in person or request a statement by mail.

Benefits of having a *salinan no akaun bank* include: Proof of income, Tracking expenses, and Fraud detection.

Advantages and Disadvantages of Sharing a *Salinan No Akaun Bank*

| Advantages | Disadvantages |

|---|---|

| Necessary for various applications (loans, visas, etc.) | Risk of identity theft if falls into the wrong hands |

| Helps track expenses and manage finances | Potential for financial fraud |

| Useful for resolving discrepancies and disputes | Privacy concerns |

Best Practice: Regularly review your statements for errors.

Best Practice: Store your statements securely.

Best Practice: Shred old statements.

Best Practice: Be cautious about sharing your account information.

Best Practice: Report any suspicious activity immediately.

FAQ: What is a *salinan no akaun bank*? It's a copy of your bank statement.

FAQ: How do I get a *salinan no akaun bank*? Contact your bank or access online banking.

FAQ: What information is included in a *salinan no akaun bank*? Transactions, balance, account details.

FAQ: How often should I review my *salinan no akaun bank*? Monthly is recommended.

FAQ: What should I do if I lose my *salinan no akaun bank*? Contact your bank immediately.

FAQ: How can I protect my *salinan no akaun bank* from fraud? Store securely and shred old copies.

FAQ: What are the risks of sharing my *salinan no akaun bank*? Identity theft and financial fraud.

FAQ: What should I do if I notice an error on my *salinan no akaun bank*? Contact your bank.

In conclusion, understanding the significance of a *salinan no akaun bank*, or bank account copy, is crucial for navigating the complexities of personal finance. From applying for loans to tracking your spending habits and protecting yourself from fraud, this document plays a vital role. By understanding the best practices for securing and utilizing your bank statements, you empower yourself to take control of your financial well-being. Be proactive, stay informed, and treat your financial information with the respect it deserves. Remember, your *salinan no akaun bank* is more than just a piece of paper; it's a reflection of your financial journey. Take care of it, and it will take care of you. Now go forth and conquer your finances!

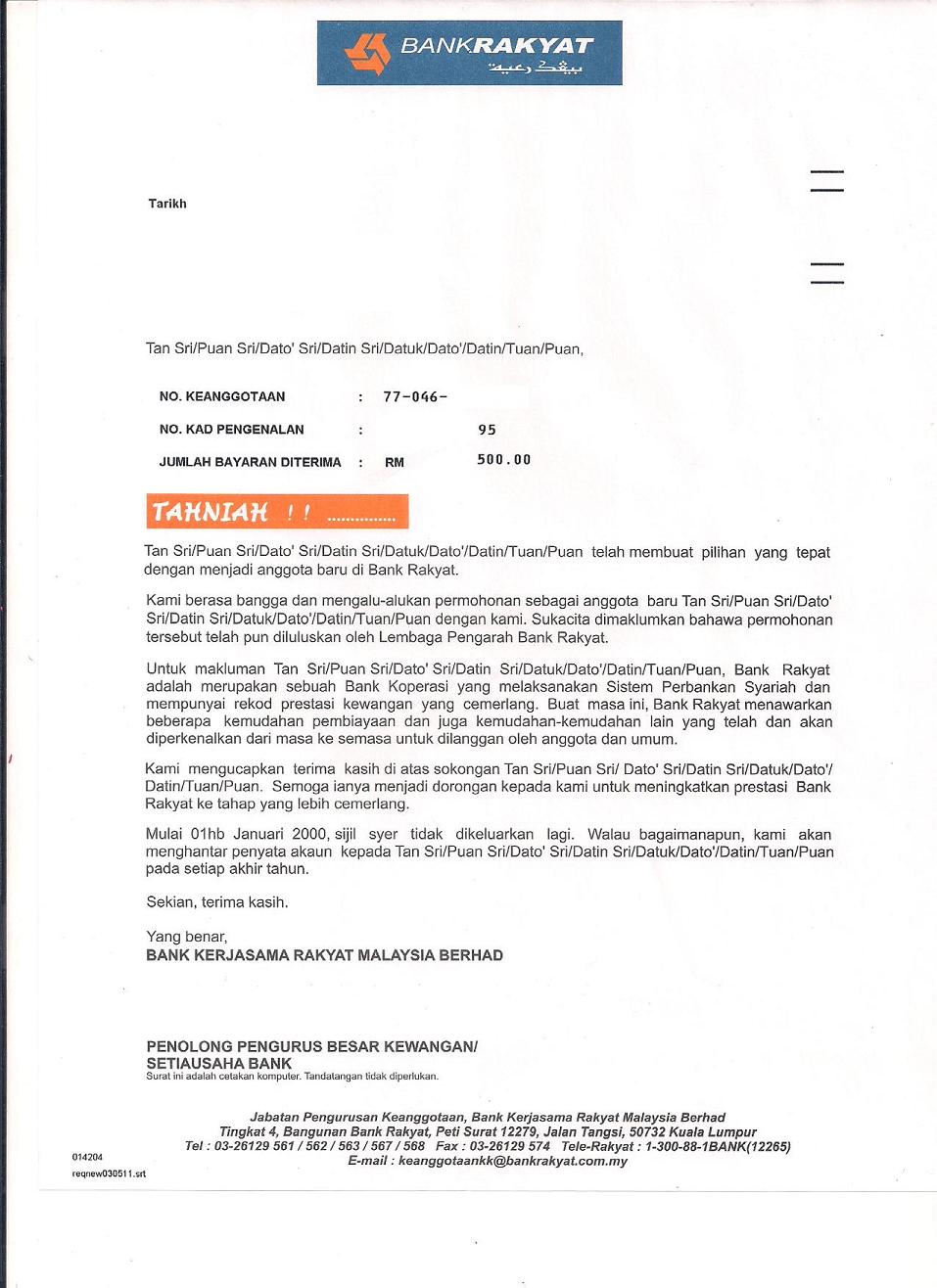

Surat Pengesahan Akaun Bank | Taqueria Autentica

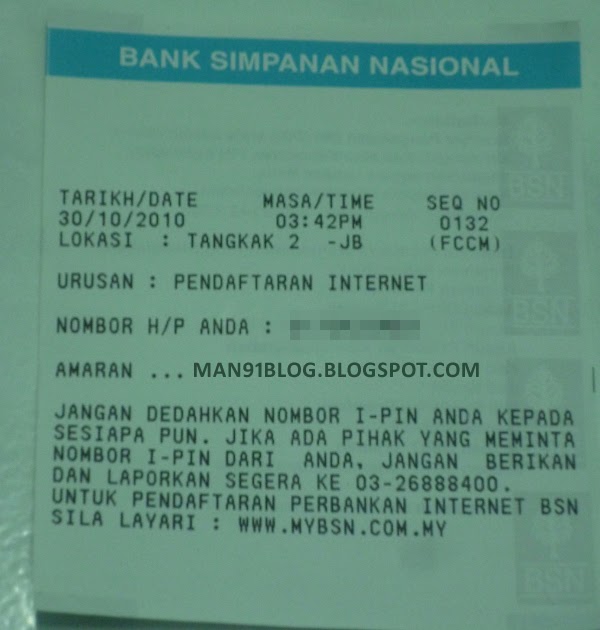

Cara Dapatkan Pengesahan Akaun Bank Penyata di Mesin ATM | Taqueria Autentica

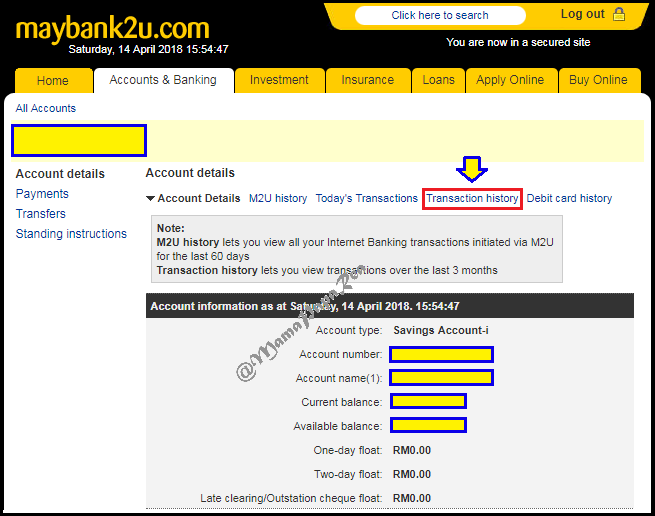

Salinan Akaun Bank Maybank | Taqueria Autentica

Salinan Akaun Bank CIMB 2023 | Taqueria Autentica

Contoh Nombor Akaun Bank | Taqueria Autentica

Cara Dapatkan Bank Statement Maybank | Taqueria Autentica

Salinan Slip Muka Depan Akaun Bank 3 Cara Dapatkan Penyata Simpanan | Taqueria Autentica

salinan akaun bank cimb | Taqueria Autentica

Salinan Akaun Bank Islam Tanpa Buku 2024 | Taqueria Autentica

salinan no akaun bank | Taqueria Autentica

Statement Contoh Penyata Akaun Bank Bsn | Taqueria Autentica

Koleksi Template Akaun Bank Simple Dan Kemas | Taqueria Autentica