Calculating Your Monthly Zakat: A Comprehensive Guide

In an age where financial planning is paramount, understanding how our faith intersects with our income takes on a new level of significance. For Muslims, Zakat, one of the five pillars of Islam, stands as a powerful tool for both spiritual growth and societal well-being. But what about those who earn a monthly income? How do we accurately calculate and fulfill this obligation?

This is where the concept of "kiraan zakat pendapatan bulanan," or the calculation of Zakat on monthly income, comes into play. It's not simply about crunching numbers; it's about aligning our financial practices with our core beliefs and ensuring that our wealth is a source of blessing, not burden.

While Zakat is often associated with annual calculations, particularly for assets like gold and silver, the principle remains the same for monthly income: to purify our earnings and contribute to the welfare of the less fortunate.

But navigating this calculation can seem daunting. This comprehensive guide aims to demystify the process, providing a clear understanding of how to accurately calculate your monthly Zakat obligation.

Whether you're new to the concept or seeking a refresher, this guide will equip you with the knowledge and resources to make informed decisions about your Zakat contributions.

Advantages and Disadvantages of Calculating Zakat on a Monthly Basis

While calculating Zakat annually is common, opting for monthly calculations offers its own set of advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

Consistent Giving: Aligns with the spirit of regular charity encouraged in Islam. | Potential for Under/Overestimation: Fluctuations in monthly income might lead to inaccurate annual Zakat amounts. |

Easier Budgeting: Incorporating Zakat into monthly expenses simplifies financial planning. | Requires More Frequent Calculations: Demands a more hands-on approach compared to annual calculations. |

Best Practices for Calculating Monthly Zakat

- Consult Local Islamic Scholars: Seek guidance from trusted religious authorities on specific calculation methods based on your income type and location.

- Use Reputable Zakat Calculators: Numerous online Zakat calculators are available. Choose one endorsed by a recognized Islamic organization.

- Maintain Detailed Records: Keep track of your income, expenses, and Zakat payments for future reference.

- Understand Your Nisab: Determine the minimum threshold (Nisab) for your assets. Zakat becomes obligatory when your wealth exceeds this threshold.

- Choose a Trustworthy Zakat Recipient: Ensure your Zakat contributions reach deserving individuals or organizations.

Common Questions About Calculating Monthly Zakat

1. Do I need to calculate Zakat on my entire monthly income?

Zakat is calculated on your net income after deducting essential expenses like housing, food, and utilities.

2. What if my income fluctuates every month?

You can either calculate Zakat on each paycheck or determine an average monthly income for consistency.

3. Can I automate my monthly Zakat payments?

Yes, many charities offer automated payment options for regular Zakat contributions.

4. Can I give Zakat to family members?

Zakat cannot be given to immediate family members (parents, spouse, children) but can be given to other relatives in need.

5. What are the consequences of not paying Zakat?

Failing to fulfill Zakat obligations is considered a major sin in Islam.

6. Can I claim tax deductions for my Zakat contributions?

Tax regulations vary by country. Consult a tax professional to understand the rules in your region.

7. What if I forgot to pay Zakat for a few months?

It's essential to make up for any missed payments as soon as you remember.

8. How can I learn more about Zakat calculation methods?

Reach out to your local mosque, Islamic scholar, or reputable online resources for further guidance.

Conclusion

Embracing "kiraan zakat pendapatan bulanan" is more than a financial duty; it's a spiritual practice that fosters gratitude, generosity, and social responsibility. By integrating this pillar of Islam into our monthly financial routines, we not only purify our wealth but also contribute to building a more just and equitable society. Understanding the principles and methods of calculating monthly Zakat empowers individuals to fulfill this obligation with confidence and sincerity. Resources like trusted Zakat calculators, guidance from Islamic scholars, and support from financial institutions can simplify this process, ensuring that our contributions are both accurate and impactful. As we strive for financial well-being, let's remember that true prosperity lies not just in accumulating wealth but in utilizing it as a means to uplift and support those in need, fulfilling the noble spirit of Zakat.

Risalah dakwah 024 zakat pendapatan bulanan | Taqueria Autentica

Cara Mudah Kira Zakat Pendapatan | Taqueria Autentica

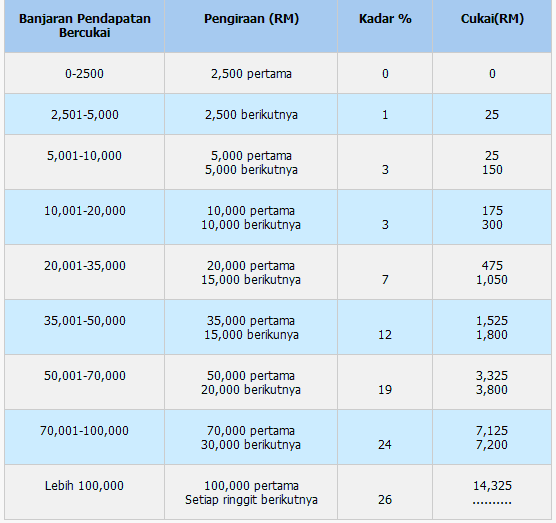

Kerja Makan Gaji Perlu Tahu Potongan Cukai Berjadual (PCB) | Taqueria Autentica

Zakat Pendapatan: Bayaran Secara Pemotongan Gaji | Taqueria Autentica

Cara Kiraan ZAKAT EMAS ambil tahu sebab ianya wajib bayar! | Taqueria Autentica

Kaedah Kiraan, Cara Bayar Zakat Simpanan di Malaysia 2024 | Taqueria Autentica

Bajet 2023: Potongan cukai pendapatan, diskaun PTPTN, pengecualian duti | Taqueria Autentica

Zakat Pendapatan Dan Cara Kiraan Mudah Hanya Rujuk Jadual Yang | Taqueria Autentica

kiraan zakat pendapatan bulanan | Taqueria Autentica

Apa Itu Zakat Pendapatan dan Cara Pengiraan Zakat Pendapatan | Taqueria Autentica

Cara Kiraan Zakat Pendapatan Bulanan : Zakat | Taqueria Autentica

JADUAL POTONGAN PCB 2012 PDF | Taqueria Autentica

Cara Pengiraan Zakat Pendapatan dan Zakat Simpanan (2.5%) | Taqueria Autentica

Bila perlu bayar zakat pendapatan dan berapa kadarnya? | Taqueria Autentica

kiraan zakat pendapatan bulanan | Taqueria Autentica