CIMB Bank Code and Branch Code: Everything You Need to Know

In today's digital age, understanding the ins and outs of online banking is crucial. When it comes to making transactions, especially international ones, having the correct bank codes is essential. CIMB Bank, a leading financial institution in Southeast Asia, utilizes a specific system of codes to identify its branches and facilitate smooth transactions. This article will serve as your go-to guide for all things related to CIMB bank codes and branch codes, equipping you with the knowledge to navigate your finances effortlessly.

Let's start by demystifying these codes. A CIMB Bank Code is a unique identifier for CIMB Bank itself, particularly useful for international transactions. On the other hand, a CIMB Branch Code is a specific code that points to the exact branch where you opened your account. These codes play a vital role in ensuring that your funds are routed correctly and securely. Imagine sending money to a friend without having their complete address; chaos would ensue! Similarly, using the correct CIMB Bank Code and Branch Code ensures your transactions reach their destination without a hitch.

But why are these codes so important? In the world of banking, accuracy is paramount. Using the right codes prevents delays, errors, and potential security risks. When you initiate a transaction, these codes act as a GPS, guiding your funds to the correct destination. Without them, your transaction could be delayed, sent to the wrong account, or even rejected altogether.

Now, you might be wondering how these codes came to be. With the rise of globalization and international banking, a standardized system for identifying banks and branches became crucial. The SWIFT/BIC code system, used globally, provides a unique identifier for each financial institution, including CIMB Bank. This system ensures seamless communication and transfer of funds between banks worldwide.

However, like any system, there can be challenges. One common issue is customers using outdated or incorrect codes. This can occur due to branch relocations, mergers, or simply human error. To avoid this, it's crucial to verify your CIMB Bank Code and Branch Code with your local branch or through the official CIMB Bank website.

Advantages and Disadvantages of CIMB Bank Code and Branch Code

| Advantages | Disadvantages |

|---|---|

| Secure and accurate transactions | Potential for errors if codes are outdated or incorrect |

| Facilitates international transactions | May require verification with the bank or website |

| Standardized system for easy identification |

Frequently Asked Questions about CIMB Bank Codes and Branch Codes:

1. What if I use the wrong CIMB Bank Code or Branch Code?

Using incorrect codes can lead to transaction delays, rejections, or misdirection of funds. It's crucial to double-check your codes before confirming any transactions.

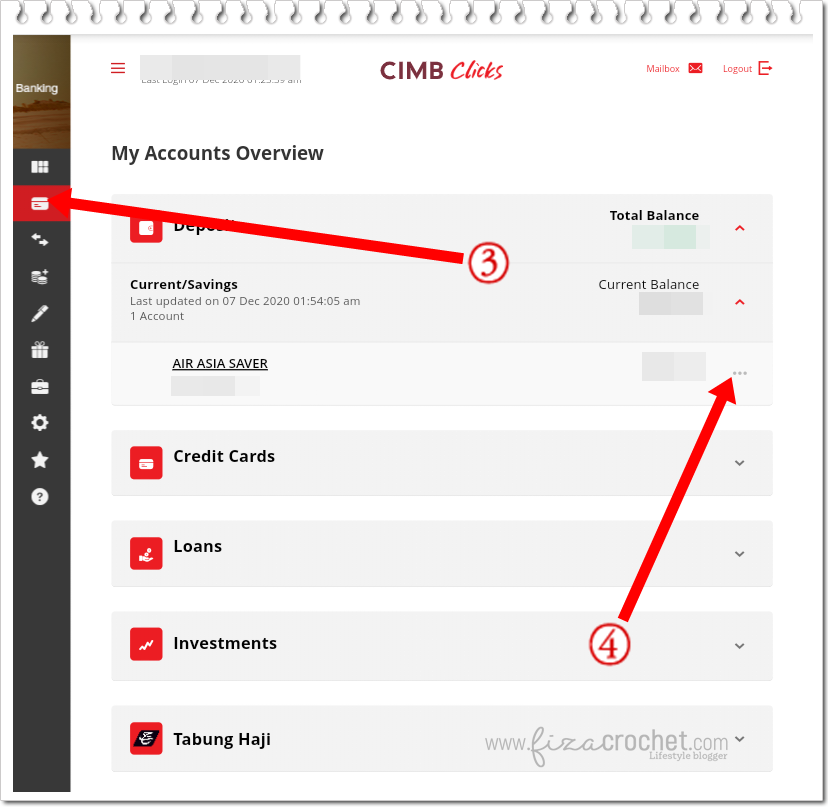

2. How do I find my CIMB Bank Branch Code?

You can find your branch code on your CIMB bank statements, checkbook, or by contacting your local CIMB branch or visiting the official website.

3. Are CIMB Bank Codes and Branch Codes the same for all countries?

No, codes may vary depending on the country of operation. It's essential to use the specific codes for the country where your account is held.

4. Is the CIMB Bank Code the same as the SWIFT/BIC code?

Yes, the CIMB Bank Code used for international transactions is essentially the bank's SWIFT/BIC code.

5. Can I find CIMB Bank Codes and Branch Codes online?

Yes, you can find this information on the official CIMB Bank website or other reputable financial websites. Always ensure you are accessing information from reliable sources.

6. How often do CIMB Bank Codes and Branch Codes change?

While these codes don't change frequently, it's best practice to verify them periodically, especially if you've moved or haven't used a specific account in a while.

7. What should I do if I suspect a fraudulent transaction related to my CIMB Bank account?

Contact CIMB Bank's customer service immediately to report any suspicious activity.

8. Can I use a CIMB Bank Code and Branch Code for transactions other than transfers?

These codes might be required for various banking transactions, including but not limited to, international wire transfers, direct debits, and other electronic fund transfers.

Tips and Tricks:

- Always double-check your CIMB Bank Code and Branch Code before confirming any transaction.

- Keep your banking information, including your codes, in a safe and secure place.

- Be wary of phishing attempts and never share your bank codes via email or suspicious websites.

- Regularly monitor your bank statements for any unauthorized transactions.

In conclusion, CIMB Bank Codes and Branch Codes are essential components of secure and efficient banking. Understanding their significance, knowing how to find them, and staying informed about best practices empowers you to navigate the world of finance with confidence. Remember to prioritize the security of your banking information and reach out to your local CIMB branch or their official website if you have any questions or require assistance.

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica

cimb bank code and branch code | Taqueria Autentica