Decoding Bank of America Check Designs: Security, Styles, and More

Ever find yourself staring at your Bank of America checks, pondering the curious patterns and intricate details? They're more than just slips of paper; they're miniature security documents with a rich history. Let's unravel the secrets behind Bank of America's check designs, from their evolution to the modern-day features that safeguard your finances.

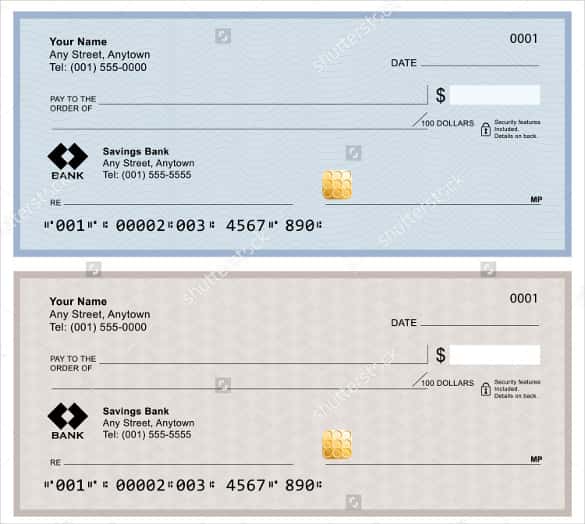

The aesthetics of a Bank of America check might seem mundane, but they're meticulously designed. These designs have evolved significantly over the years, reflecting advancements in security and technology. Early checks were simple, relying primarily on signatures for authentication. Now, they incorporate complex backgrounds, microprinting, and other elements to deter fraud.

Understanding these designs is crucial for both security and practical reasons. Recognizing legitimate Bank of America check layouts helps protect you from counterfeits and scams. It also facilitates smooth transactions, ensuring your checks are processed efficiently.

Bank of America check formats aren't just about looks; they're about functionality. Specific locations for account and routing numbers ensure compatibility with automated processing systems. The inclusion of security features, like watermarks and magnetic ink, adds layers of protection against fraudulent activities.

Beyond the basic design elements, there's a surprising amount of variation within Bank of America check styles. Customers can choose from different background images, personalize with their names or business logos, and even order checks with unique themes. This personalization allows for individual expression while maintaining the necessary security features.

The history of Bank of America check design mirrors the evolution of banking itself. From handwritten drafts to standardized forms, check designs have adapted to technological advancements and security needs. The importance of these designs lies in their role in facilitating secure and reliable financial transactions.

A significant issue concerning Bank of America check designs is the potential for fraud. Counterfeit checks are a persistent problem, requiring ongoing improvements in security features and public awareness. Understanding how to identify legitimate checks is vital for individuals and businesses alike.

One of the benefits of personalized Bank of America checks is the added layer of security. A unique background image makes it more difficult for fraudsters to replicate your checks. Furthermore, ordering checks directly from Bank of America or an authorized vendor ensures you receive genuine, secure documents.

Another advantage is the convenience and professionalism of customized checks. Business owners can reinforce their branding by including their company logo and contact information. Individuals can choose designs that reflect their personal style or interests, adding a touch of personality to their financial transactions.

Finally, using authentic Bank of America check formats ensures compatibility with automated processing systems. This streamlining minimizes errors and delays in check clearing, making your financial transactions more efficient.

Advantages and Disadvantages of Customized Bank of America Checks

| Advantages | Disadvantages |

|---|---|

| Enhanced Security | Potential Cost (depending on design) |

| Personalized Branding | Requires Ordering through Official Channels |

| Improved Processing Efficiency |

Best practice is to always order your checks directly from Bank of America or an authorized provider. This ensures the checks you receive are authentic and contain the necessary security features to protect you from fraud.

In conclusion, Bank of America check designs are more than meets the eye. They are a blend of security, functionality, and even personal expression. Understanding their evolution, features, and best practices is crucial for protecting your finances and ensuring smooth transactions. From security measures to personalization options, the design of your check plays a vital role in the financial ecosystem. By staying informed and utilizing the resources available, you can maximize the benefits and minimize the risks associated with using Bank of America checks. Be sure to always order your checks through official channels and report any suspicious activity immediately. Your financial security is paramount, and understanding the intricacies of your checks is a significant step towards protecting it.

real bank of america check designs | Taqueria Autentica

Bank of America Order Checks Online | Taqueria Autentica

Bank Of America Número De Cuenta De Cheque Y Número De Ruta | Taqueria Autentica

Cómo llenar un cheque Chase paso a paso 2024 | Taqueria Autentica

Bank Of America Bank Statement Template | Taqueria Autentica

Bank Of America Check Template Download | Taqueria Autentica

Bank Of America Check Template Download | Taqueria Autentica

bank of america checks | Taqueria Autentica

Free Check Printing Template | Taqueria Autentica

Do Bank Checks Cost Money at Darcy Lopez blog | Taqueria Autentica

Bank Of America Printable Checks | Taqueria Autentica

real bank of america check designs | Taqueria Autentica

real bank of america check designs | Taqueria Autentica

real bank of america check designs | Taqueria Autentica

How To Order Checks From Bank of America 4 Easy Steps | Taqueria Autentica