Decoding Payroll: The Ultimate Guide to Accurate Salary Calculation

In the intricate dance of human resources, few tasks hold the weight and significance of payroll. It's the lifeblood of an organization, the fuel that keeps the engine of productivity humming. And at the heart of this crucial process lies a fundamental understanding of salary calculation. This is no mere arithmetic exercise; it's a nuanced system that impacts employee morale, legal compliance, and a company's financial health.

Think of it as a complex equation where every variable matters. From the hours clocked to bonuses earned, each element plays a role in determining an employee's final paycheck. A misstep in this process can lead to disgruntled employees, legal ramifications, and a dent in your company's reputation.

The journey begins with grasping the concept of gross pay—the total earnings before any deductions. This encompasses base salary, overtime pay, commissions, and bonuses. It's the first building block in our payroll pyramid, laying the foundation for a fair and transparent compensation system.

But the path to a final paycheck is rarely straightforward. Next, we navigate the realm of deductions, a world filled with taxes, insurance premiums, and retirement contributions. Each deduction chips away at the gross pay, ultimately revealing the net pay—the actual amount deposited into an employee's account.

Mastering this intricate dance of additions and subtractions is crucial for any business, big or small. Accurate salary calculation fosters trust with your employees, ensures legal compliance, and streamlines your financial operations. It's an investment in your company's well-being, a commitment to fairness and transparency that resonates far beyond the balance sheet. So, let's delve into the heart of payroll, exploring the tools, techniques, and best practices that guarantee accurate and efficient salary disbursement.

Advantages and Disadvantages of Manual vs. Automated Payroll Systems

While the principles of salary calculation remain universal, the methods employed have evolved dramatically. Let's compare:

| Feature | Manual (Spreadsheets) | Automated (Payroll Software) |

|---|---|---|

| Accuracy | Prone to human error | Minimizes errors with automated calculations |

| Time Efficiency | Time-consuming, especially for large payrolls | Significantly faster, freeing up HR for strategic tasks |

| Cost | Seems cheaper initially, but prone to costly errors | Subscription fees, but offers long-term cost savings and efficiency |

| Compliance | Difficult to stay updated with changing regulations | Software automatically updates with latest tax laws and regulations |

Best Practices for Flawless Payroll Management

Navigating the landscape of payroll requires precision and diligence. Here are five best practices to ensure smooth sailing:

1. Embrace Technology: In today's digital age, clinging to manual spreadsheets is like navigating with a compass in a GPS world. Payroll software automates calculations, minimizes errors, and simplifies tax compliance.

2. Maintain Accurate Records: Meticulous record-keeping is the bedrock of accurate payroll. Maintain detailed records of employee hours, leave, bonuses, and deductions. These records are not just for your reference; they are crucial for audits and legal compliance.

3. Understand Legal Requirements: Payroll is not just about numbers; it's about navigating a complex web of legal obligations. Stay updated on tax laws, minimum wage requirements, and other regulations that impact your payroll process.

4. Prioritize Data Security: Payroll data is sensitive and confidential. Employ robust security measures to protect this information from unauthorized access, breaches, or cyber threats. Regularly back up your data and restrict access to authorized personnel only.

5. Seek Professional Help: Payroll can be complex, especially for businesses operating across multiple states or countries. Don't hesitate to seek professional help from payroll specialists or accountants. Their expertise can save you from costly errors and legal headaches.

Frequently Asked Questions

1. What is the difference between gross pay and net pay?

Gross pay is the total amount an employee earns before any deductions, while net pay is the final amount they receive after taxes, insurance, and other deductions are taken out.

2. How are overtime hours calculated?

Overtime hours are typically hours worked beyond the standard 40-hour workweek. The overtime rate is often 1.5 times the regular hourly rate, but specific regulations vary by location.

3. What are common payroll deductions?

Common deductions include federal and state income tax, Social Security taxes, Medicare taxes, health insurance premiums, retirement plan contributions, and wage garnishments (if applicable).

4. How often should payroll be processed?

Payroll frequency can be weekly, bi-weekly, semi-monthly, or monthly, depending on company policy and local regulations.

5. What are the penalties for payroll errors?

Penalties for payroll errors can be severe, including back taxes, fines, interest payments, legal lawsuits, and damage to the company's reputation.

6. What is a payroll tax ID number?

A payroll tax ID number, also known as an Employer Identification Number (EIN), is used by the IRS to identify businesses for tax purposes. You need an EIN to process payroll and deposit taxes.

7. How can I prevent payroll fraud?

Implement internal controls, such as segregation of duties, regular audits, and employee background checks, to prevent and detect fraudulent activities.

8. What are some resources for staying updated on payroll regulations?

The IRS website, the U.S. Department of Labor, and reputable payroll service providers are excellent resources for staying informed about changing regulations.

Conclusion: Navigating the Payroll Labyrinth with Confidence

Mastering the art of salary calculation is not a mere checkbox on an HR to-do list; it's the foundation of a healthy and productive workplace. By understanding the components of gross pay, navigating the intricacies of deductions, and staying compliant with ever-evolving regulations, businesses can ensure financial stability and foster a culture of trust and transparency. While the journey may seem daunting, armed with the right tools, technology, and expert guidance, companies can confidently navigate the payroll labyrinth and unlock a world of efficiency, accuracy, and employee satisfaction.

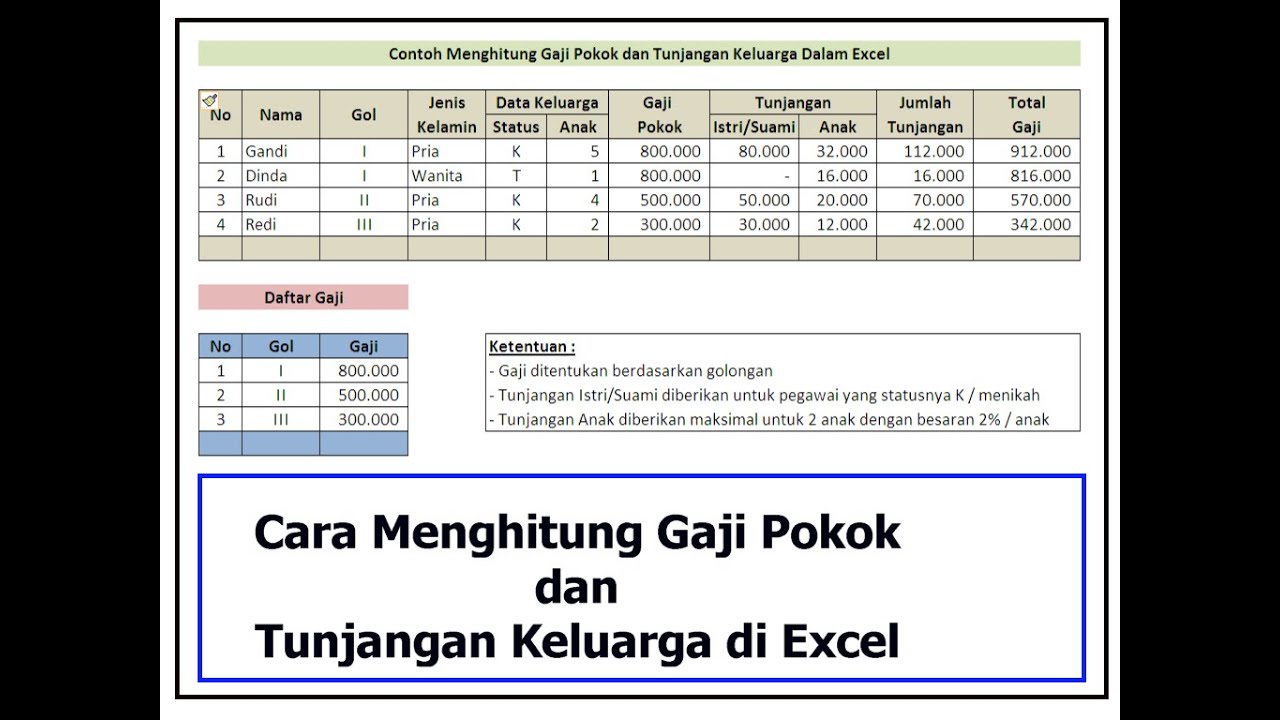

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

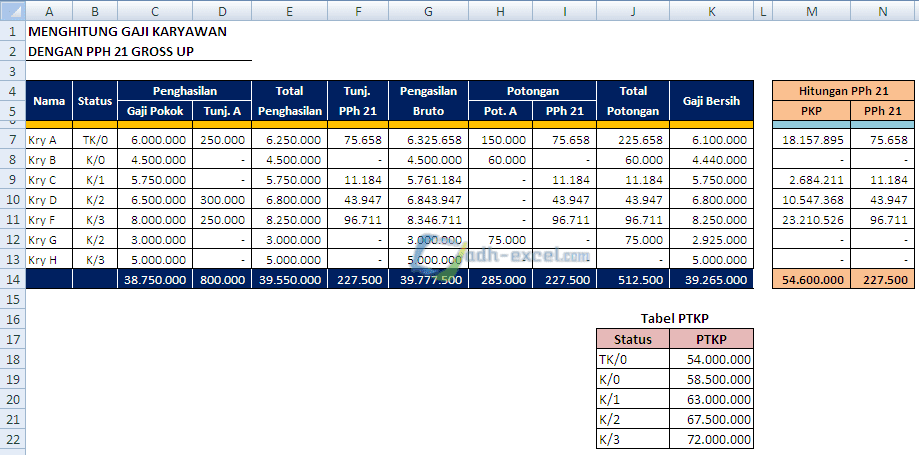

Contoh perhitungan upah lembur | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica

cara menghitung gaji karyawan | Taqueria Autentica