Decoding the JP Morgan Chase Wire Transfer Address

Navigating the world of international finance can feel like stepping into a labyrinth. One crucial piece of information often needed is the correct incoming wire transfer address for your bank. If you're dealing with JP Morgan Chase, this seemingly simple task can sometimes feel overwhelming. This article aims to demystify the process and provide you with a clear understanding of how to obtain and use the correct JP Morgan Chase incoming wire address information.

Whether you're receiving funds from abroad or domestically, having the accurate JP Morgan Chase wire instructions is paramount. Mistakes can lead to delays, returned funds, and unnecessary fees. This guide will equip you with the knowledge you need to confidently manage your incoming wire transfers.

Finding the correct address isn't always straightforward. JP Morgan Chase, like many large financial institutions, has different addresses for various types of transactions and currencies. This complexity is designed to streamline internal processing but can often be confusing for customers. We’ll explore the different scenarios and help you pinpoint the correct information for your specific needs.

We'll cover a range of topics, from understanding the components of a JP Morgan Chase wire transfer address, such as the SWIFT code and bank branch identifier, to exploring the importance of accuracy when initiating or receiving these transactions. We’ll also delve into common issues encountered during the process and offer practical solutions to overcome them.

Furthermore, we will look at best practices for ensuring smooth transactions, including verifying details with your recipient, understanding the fees associated with incoming wire transfers, and keeping records of your transactions. This comprehensive guide is your one-stop resource for all things related to JP Morgan Chase incoming wire transfer addresses.

Historically, wire transfers have played a significant role in moving large sums of money across borders. With the rise of globalization and digital banking, their importance has only grown. JP Morgan Chase, being a key player in international finance, handles a vast volume of wire transfers daily. Understanding the intricacies of their system is therefore essential for anyone engaged in cross-border transactions.

The JP Morgan Chase incoming wire address comprises several essential elements, including the SWIFT code, which identifies the bank internationally, the bank's name and address, and potentially further details like a branch identifier or account number. Providing accurate and complete information is critical for successful processing. Incorrect or missing details can lead to delays, returned funds, or even misdirection of the transfer.

Securing your financial information is of utmost importance. While using JP Morgan Chase’s wire transfer services, be cautious of phishing scams or fraudulent requests for your bank details. Never share sensitive information via email or unsecured channels. Always confirm the recipient’s identity and verify wire instructions directly with the bank if you have any doubts.

One key benefit of utilizing the JP Morgan Chase wire transfer system is its speed. Compared to traditional methods like checks, wire transfers are significantly faster, allowing for quick access to funds. Another advantage is its global reach, enabling you to send and receive money internationally. Lastly, the robust security measures implemented by JP Morgan Chase help protect your transactions from fraud.

To initiate a wire transfer to your JP Morgan Chase account, you’ll need to provide the sender with the correct incoming wire instructions. These instructions can typically be found on your online banking platform or by contacting your bank directly. Ensure all details are accurate before sharing them.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed and efficiency | Cost (fees can be significant) |

| Global reach | Irreversible nature (mistakes can be costly) |

| Security measures | Potential for fraud if not handled carefully |

Frequently Asked Questions:

Q1: How do I find my JP Morgan Chase incoming wire address? A: Contact your bank or access your online banking platform for detailed instructions.

Q2: What information is needed for a JP Morgan Chase incoming wire transfer? A: SWIFT code, bank address, account number, and potentially additional details specific to your account.

Q3: What are the fees associated with incoming wire transfers? A: Contact JP Morgan Chase directly for information regarding their fee schedule.

Q4: How long does it take for a wire transfer to arrive? A: Typically, international wire transfers can take a few business days.

Q5: What should I do if my wire transfer is delayed? A: Contact JP Morgan Chase customer support to investigate the issue.

Q6: Can I cancel a wire transfer once it has been sent? A: Contact JP Morgan Chase immediately. Cancellation might be possible if the transfer hasn't been processed yet.

Q7: Is it safe to provide my JP Morgan Chase wire transfer details online? A: Only share this information on secure banking platforms or directly with authorized bank personnel.

Q8: What should I do if I suspect fraudulent activity related to my wire transfer? A: Contact JP Morgan Chase immediately and report the incident.

In conclusion, navigating the specifics of JP Morgan Chase incoming wire addresses is crucial for seamless international and domestic fund transfers. By understanding the components of the address, utilizing provided resources, and employing best practices, you can ensure secure and efficient transactions. Remember to always double-check information, be vigilant against fraud, and utilize the support services offered by JP Morgan Chase to resolve any issues. Mastering this aspect of your financial management will empower you to confidently conduct business in a globalized world. This knowledge offers peace of mind and allows you to focus on your financial goals knowing your funds are being handled with accuracy and security.

JPMorgan Chase Headquarters Address | Taqueria Autentica

How To Wire From Capital One | Taqueria Autentica

Us Bank Wiring Instructions | Taqueria Autentica

Fillable Online Jp Morgan Chase Incoming Wire Transfer Fax Email Print | Taqueria Autentica

Chase International Wire Transfer International Credit Cards and ATM | Taqueria Autentica

chase wire transfer to bank of america Can you download on a forum | Taqueria Autentica

Chase Bank Wire Transfers How to Send Fees Routing Numbers 2021 | Taqueria Autentica

Ally Bank CheckingSavings Review | Taqueria Autentica

guépard St jeter de la poussière dans les yeux wire money chase Savon | Taqueria Autentica

Td Bank Wiring Instructions | Taqueria Autentica

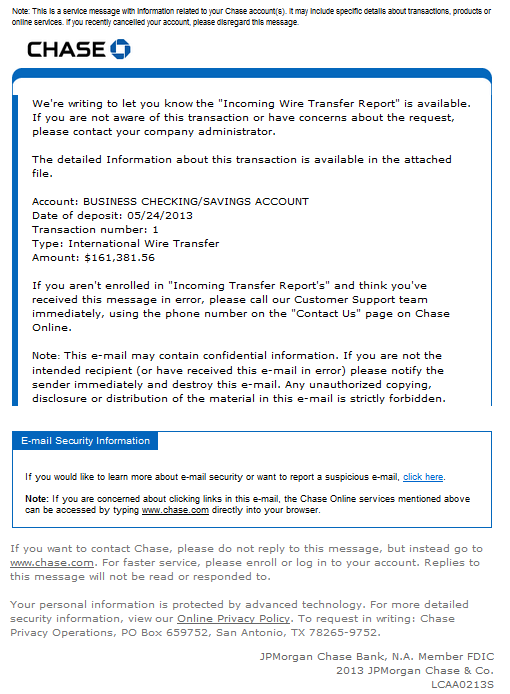

Dynamoos Blog Chase Incoming Wire Transfer spam incomingwire | Taqueria Autentica

Pnc Bank Wiring Instructions | Taqueria Autentica

Truist Bank Domestic Wiring Instructions | Taqueria Autentica

Wiring Money At Walmart at Maria Miller blog | Taqueria Autentica

Linderung injizieren Anfällig für chase electronic routing number | Taqueria Autentica