Decoding US Bank Cashier's Check Limits: A Comprehensive Guide

In today's fast-paced financial landscape, understanding the nuances of various payment instruments is crucial. Cashier's checks, often perceived as a secure and guaranteed form of payment, raise questions regarding limitations, particularly when dealing with substantial transactions. This guide delves into the specifics of US Bank cashier's check limits, providing a comprehensive overview for individuals and businesses alike.

What exactly are the constraints on US Bank cashier's checks? While US Bank doesn't publicly advertise a specific maximum limit for cashier's checks, it's important to understand that limitations can vary depending on factors such as the customer's relationship with the bank, the branch location, and the specific purpose of the check. For larger amounts, contacting your local branch is essential to discuss the feasibility and any specific requirements.

The concept of a cashier's check has evolved significantly over time. Originally, these checks provided a more secure alternative to personal checks, especially for larger sums. In an era predating widespread electronic payments, cashier's checks offered a tangible guarantee of funds, minimizing the risk of bounced checks. Today, despite the rise of digital transactions, they remain relevant for specific situations like real estate transactions or other high-value purchases.

The significance of understanding US Bank's approach to cashier's check limits lies in facilitating smooth and efficient transactions. Being aware of potential limitations prevents delays and ensures you have the necessary information to navigate the process effectively. This knowledge empowers individuals and businesses to plan their financial activities accordingly.

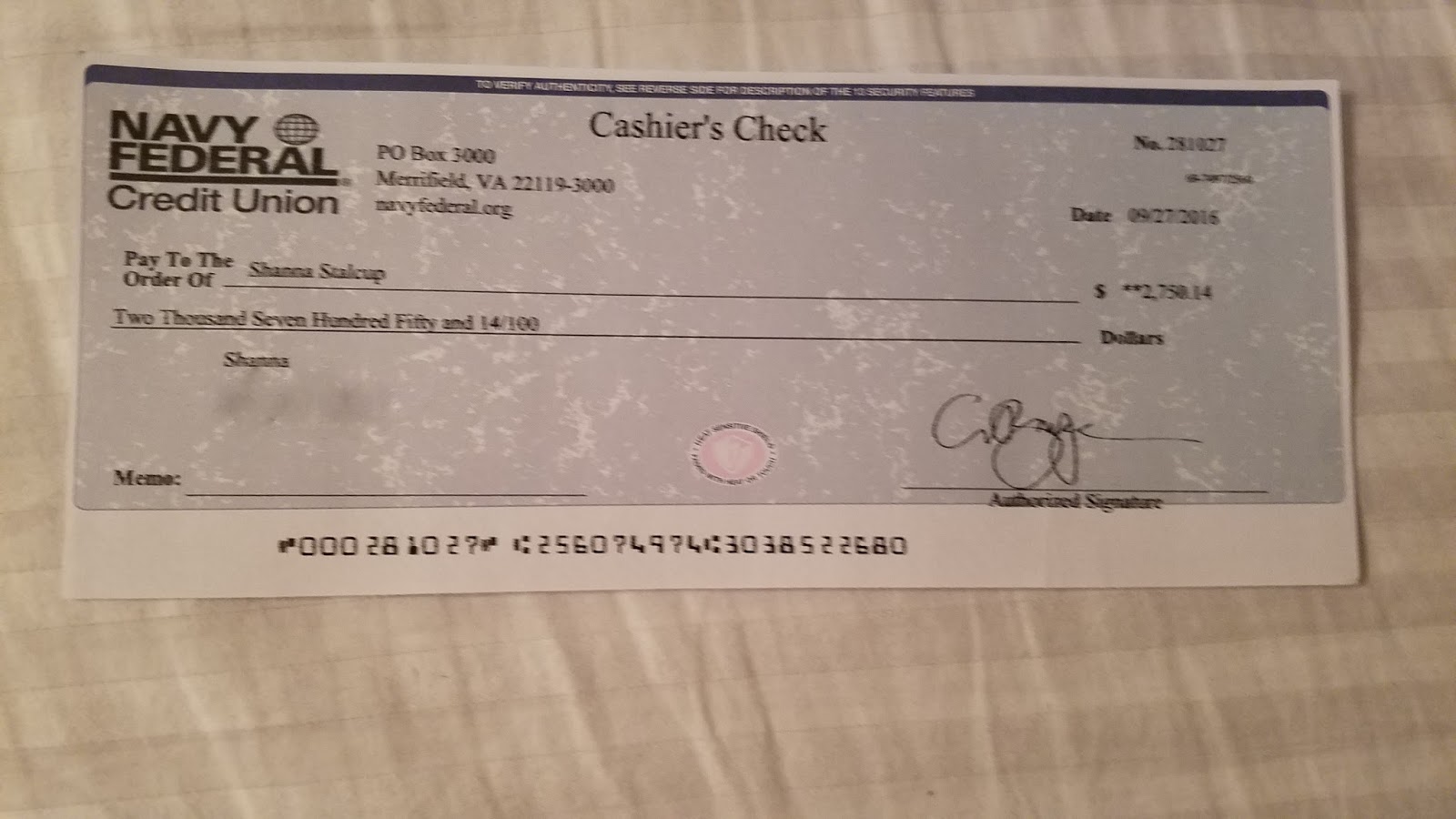

One of the key issues surrounding cashier's check limits revolves around fraud prevention. While cashier's checks are generally considered safer than personal checks, they can still be subject to counterfeiting or alteration. By implementing limits and verification procedures, banks aim to mitigate these risks and protect both themselves and their customers.

A cashier's check is a check drawn on the bank's own funds, guaranteeing payment. Unlike a personal check, the funds are withdrawn from the bank's account, not the individual's, providing greater assurance to the recipient. For example, if you need to make a down payment on a house, a cashier's check offers a secure method of transferring a substantial sum.

While US Bank doesn't disclose a specific maximum limit, it's advisable to contact your branch for substantial transactions. Understanding these practical considerations is vital for navigating larger financial commitments.

Although US Bank doesn't have a publicly advertised maximum limit, there are still several advantages to using cashier's checks. They offer guaranteed funds, enhanced security, and wider acceptance compared to personal checks, especially for significant transactions.

Advantages and Disadvantages of Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed Payment | Potential Fees |

| Enhanced Security | Requires a Bank Visit |

| Wide Acceptance | Limited Traceability Compared to Electronic Payments |

Frequently Asked Questions:

1. What is the limit for a US Bank cashier's check? As mentioned, contact your local branch for details.

2. How do I get a cashier's check from US Bank? Visit your local branch with valid identification and the necessary funds.

3. Are there fees associated with cashier's checks? Yes, fees can apply; inquire at your local branch.

4. Can a cashier's check be canceled? Under specific circumstances and with appropriate documentation, it might be possible.

5. How long is a cashier's check valid? Generally, they remain valid indefinitely, but it's advisable to deposit or cash them promptly.

6. What information is needed to obtain a cashier's check? You'll need valid identification, the recipient's name, and the payment amount.

7. Are cashier's checks traceable? They offer limited traceability compared to electronic payments.

8. Are there alternatives to cashier's checks for large transactions? Wire transfers and certified checks are alternative options.

Tips for using cashier's checks: Keep a copy of the check for your records, verify the recipient's information carefully, and consider electronic payment options for increased traceability.

In conclusion, navigating the landscape of US Bank cashier's check limits requires a nuanced understanding of both the bank's policies and the broader context of financial transactions. While a specific maximum limit isn't publicly advertised, it's crucial to recognize the importance of contacting your local branch for larger sums. Cashier's checks continue to hold relevance in today's digital age, offering a secure method for high-value payments. By understanding the intricacies of obtaining and utilizing these checks, individuals and businesses can make informed financial decisions, ensuring smooth and secure transactions. This knowledge empowers you to navigate the complexities of modern finance, optimizing your financial strategies and mitigating potential risks. Remember to consult with a US Bank representative for the most up-to-date information and tailored guidance.

What is a cashiers check | Taqueria Autentica

us bank cashier's check limit | Taqueria Autentica

Cashiers Check Guide What Its Used For How To Get One 47 OFF | Taqueria Autentica

Citizens National Bank Cashiers Check | Taqueria Autentica

What Is The Starting Check Number at Krystle Jordan blog | Taqueria Autentica

Cash Check With Square at Reuben Cawley blog | Taqueria Autentica

Roy Ngerng relied on personal savings for first repayment of S30000 | Taqueria Autentica

us bank cashiers check | Taqueria Autentica

Do Bank Checks Cost Money at Darcy Lopez blog | Taqueria Autentica

Fintech giant The Clearing House joins open | Taqueria Autentica

Wells Fargo Aba Wiring Number | Taqueria Autentica

4 Easy Ways to Verify a Cashiers Check | Taqueria Autentica

TAB Bank Cashiers Check Request 2013 | Taqueria Autentica

Wire Transfer Navy Federal Credit Union Limit | Taqueria Autentica

Resultado De Imagen Para Bank Of America Usa Cashiers Check Samples 253 | Taqueria Autentica