Decoding Your Bank of America Checks: A Comprehensive Guide

Navigating the world of personal finance can feel like traversing a complex maze. One essential tool that continues to play a crucial role is the humble check. For Bank of America customers, understanding how to utilize checks effectively is key to managing their finances. This comprehensive guide will delve into the various aspects of Bank of America checks, providing valuable insights and practical advice for both new and experienced customers.

Whether you're depositing a paycheck, paying bills, or transferring funds, Bank of America checks are a fundamental part of many financial transactions. From understanding how to write a check correctly to exploring the different ways to deposit them, this guide will empower you with the knowledge to navigate the world of Bank of America checks with confidence. We'll explore the history of checks, their modern-day relevance, and the digital tools Bank of America offers to streamline your checking experience.

In today's increasingly digital landscape, understanding the nuances of Bank of America check processing and the available resources can be incredibly beneficial. This includes leveraging online banking tools to monitor your account balance, track check deposits, and even order new checks. We will address common questions, provide helpful tips, and offer best practices to ensure your checking experience is as smooth and efficient as possible.

From verifying the availability of funds to understanding how to avoid check fraud, staying informed is crucial for managing your Bank of America checking account effectively. This guide aims to be your go-to resource for all things related to Bank of America checks, offering a clear and concise explanation of the key concepts and practices you need to know. We'll cover various scenarios, such as dealing with lost or stolen checks, stopping payment on a check, and understanding the different types of checks available.

So, let's dive into the world of Bank of America checks and unlock the essential information you need to navigate your finances with confidence. This guide will equip you with the tools and knowledge to manage your checking account effectively and make the most of the services Bank of America provides.

Historically, checks have been a cornerstone of financial transactions, providing a tangible record of payment. With Bank of America, the evolution of check usage has mirrored broader industry trends, moving towards digital solutions. Online banking and mobile check deposit have revolutionized how customers interact with their checks, offering increased convenience and accessibility. The importance of understanding Bank of America's specific check policies and procedures lies in ensuring seamless transactions and avoiding potential issues.

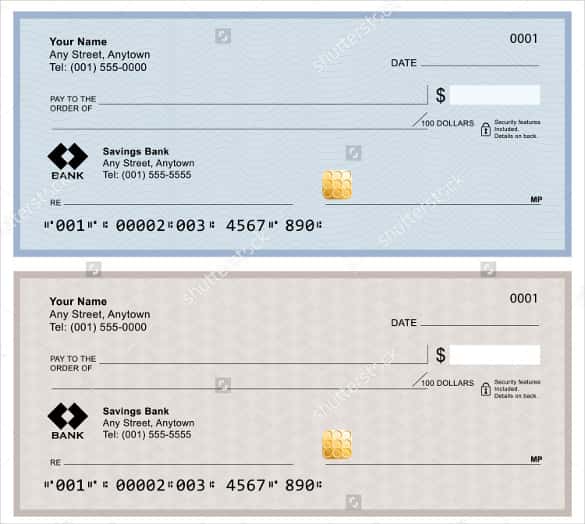

A Bank of America check is a negotiable instrument that authorizes the bank to transfer funds from your account to the recipient named on the check. Writing a check involves filling in the date, payee name, amount in numerical and written form, and your signature. Verifying available funds before writing a check is essential to prevent overdrafts. You can check your balance through online banking, the mobile app, or by contacting customer service.

Benefits of using Bank of America checks: 1) Tangible Record: Checks provide a physical record of transactions. 2) Wide Acceptance: Checks are widely accepted by businesses and individuals. 3) Control over Payment: You control when funds are withdrawn from your account.

Advantages and Disadvantages of Using Checks

| Advantages | Disadvantages |

|---|---|

| Physical Record | Processing Time |

| Wide Acceptance | Risk of Loss or Theft |

| Control over Payment Timing | Potential for Overdraft |

Best Practices for Using Bank of America Checks: 1) Always keep your checks in a secure place. 2) Verify your account balance before writing a check. 3) Use a pen with indelible ink to prevent alterations. 4) Record all issued checks in your check register. 5) Regularly reconcile your bank statement with your check register.

Frequently Asked Questions:

1. How do I order new checks? Answer: You can order checks online, through the mobile app, or by visiting a branch.

2. What do I do if I lose a check? Answer: Contact Bank of America immediately to report the lost check and request a stop payment.

3. How can I deposit a check? Answer: You can deposit checks through mobile deposit, ATMs, or at a branch.

4. How long does it take for a check to clear? Answer: Check clearing times vary depending on the type of check and the amount.

5. What is a cashier's check? Answer: A cashier's check is guaranteed by the bank and drawn from the bank's funds.

6. How do I void a check? Answer: Write "VOID" in large letters across the check.

7. Can I track my check deposits online? Answer: Yes, you can track check deposits through online banking and the mobile app.

8. What is mobile check deposit? Answer: Mobile check deposit allows you to deposit checks using your smartphone's camera.

Tips and Tricks: Take advantage of Bank of America's mobile app for convenient check management. Set up account alerts to be notified of deposits and withdrawals. Regularly review your account statements to monitor your check activity.

In conclusion, understanding the intricacies of Bank of America checks is essential for effective financial management. From writing checks correctly to utilizing digital tools for deposits and tracking, staying informed empowers you to navigate your checking account with ease. By following best practices, understanding the benefits and potential challenges, and utilizing the resources available, you can maximize the efficiency and security of your Bank of America checking experience. Leveraging mobile banking, online tools, and staying aware of your account activity are crucial for maintaining control over your finances and making informed decisions. Embrace the convenience of modern banking tools while remaining vigilant about security and best practices to ensure a seamless and successful checking experience with Bank of America. This knowledge will not only help you avoid potential issues but also contribute to a more organized and efficient approach to managing your personal finances. Take advantage of the resources available and prioritize staying informed to make the most of your Bank of America checking account.

Wiring Money Bank Of America | Taqueria Autentica

11 Cashiers Check Bank America Stock Video Footage | Taqueria Autentica

check for bank of america | Taqueria Autentica

How to Find Account Number on Check | Taqueria Autentica

Answered Aspero Inc has sales of | Taqueria Autentica

Bank Of America Número De Cuenta De Cheque Y Número De Ruta | Taqueria Autentica

Bank of America Casher Check 50 | Taqueria Autentica

Bank Of America Check Template | Taqueria Autentica

check for bank of america | Taqueria Autentica

Free Check Printing Template | Taqueria Autentica

How To Cash A Cashiers Check At Bank Of America | Taqueria Autentica

Bank Of America Printable Checks | Taqueria Autentica

Bank Of America Logo History The Bank Of America Symbol | Taqueria Autentica

Bank of america check wire transfer status | Taqueria Autentica

Kenwood Tk 3140 Software Download Zipl | Taqueria Autentica