Decoding Your Payslip: A Guide to Understanding Monthly Tax Deductions

We've all been there, staring at our payslip, wondering where exactly our hard-earned money disappears to each month. It's like a financial puzzle, with taxes often feeling like the most perplexing piece. But what if I told you that understanding your monthly tax deductions doesn't have to be a headache-inducing experience? What if you could decode those numbers and gain a clearer picture of your finances?

Let's be honest, dealing with taxes isn't exactly the most exhilarating way to spend an afternoon. But, having a firm grasp of how your monthly tax deductions are calculated is empowering. It allows you to plan your finances more effectively, ensure you're not overpaying, and even identify potential tax benefits you might be missing out on. Think of it as a financial wellness journey, and understanding your payslip is the first crucial step.

In many countries, the system for deducting taxes directly from your salary is designed to make life easier. Instead of facing a hefty tax bill at the end of the year, the government collects a portion of your income tax throughout the year, making it a more manageable process. But, the way these deductions are calculated can vary significantly depending on your location, income level, and individual circumstances.

That's where this comprehensive guide comes in. We'll break down the complexities of monthly tax deductions, providing you with the knowledge and tools to understand exactly how much tax you're paying and why. Whether you're a seasoned professional or just starting your career, this guide will equip you to navigate the world of taxes with confidence and clarity.

Remember, knowledge is power, and understanding your monthly tax deductions is the first step towards taking control of your financial well-being. So, grab your favorite beverage, get comfortable, and let's demystify the world of payslips together.

Advantages and Disadvantages of Monthly Tax Deductions

While the concept of monthly tax deductions aims to simplify our financial lives, it's essential to acknowledge both the advantages and disadvantages associated with this system.

| Advantages | Disadvantages |

|---|---|

| Predictable Cash Flow: Monthly deductions make budgeting easier as you know how much tax will be withheld from each paycheck. | Overpayment Potential: If your income fluctuates throughout the year, you may end up overpaying taxes and needing a refund. |

| Reduced Year-End Tax Burden: With taxes deducted throughout the year, you're less likely to face a large tax bill come tax season. | Limited Control: Monthly deductions offer minimal flexibility to adjust your tax payments based on changes in your financial situation. |

| Forced Savings: Consider it a forced savings plan. If you overpay, you'll receive a refund, which can be a welcome bonus. | Reduced Investment Opportunities: Money deducted for taxes is not immediately available for investments, potentially impacting long-term growth. |

Best Practices for Managing Your Monthly Tax Deductions

Taking control of your monthly tax deductions can save you money and reduce financial stress. Here are some best practices to implement:

- Review Your Tax Withholding: Regularly review your tax withholding information with your employer, especially after major life changes like marriage or having a child.

- Utilize Tax Software or Consult a Professional: Explore tax software or seek guidance from a tax advisor to optimize your deductions and identify potential savings.

- Stay Informed About Tax Laws: Tax regulations change periodically. Stay updated on any new laws or deductions that may affect your tax liability.

- Maintain Accurate Records: Keep thorough records of your income, expenses, and any relevant tax documents for easy reference during tax season.

- Plan for the Future: Consider your long-term financial goals and adjust your tax withholding accordingly to align with your investment or savings plans.

Understanding your monthly tax deductions is essential for anyone wanting to take charge of their finances. While the process might seem daunting, remember that knowledge is power. By familiarizing yourself with the basics, utilizing available resources, and adopting proactive financial habits, you can confidently navigate the world of taxes and pave the way for a more secure financial future.

cara kira potongan cukai bulanan | Taqueria Autentica

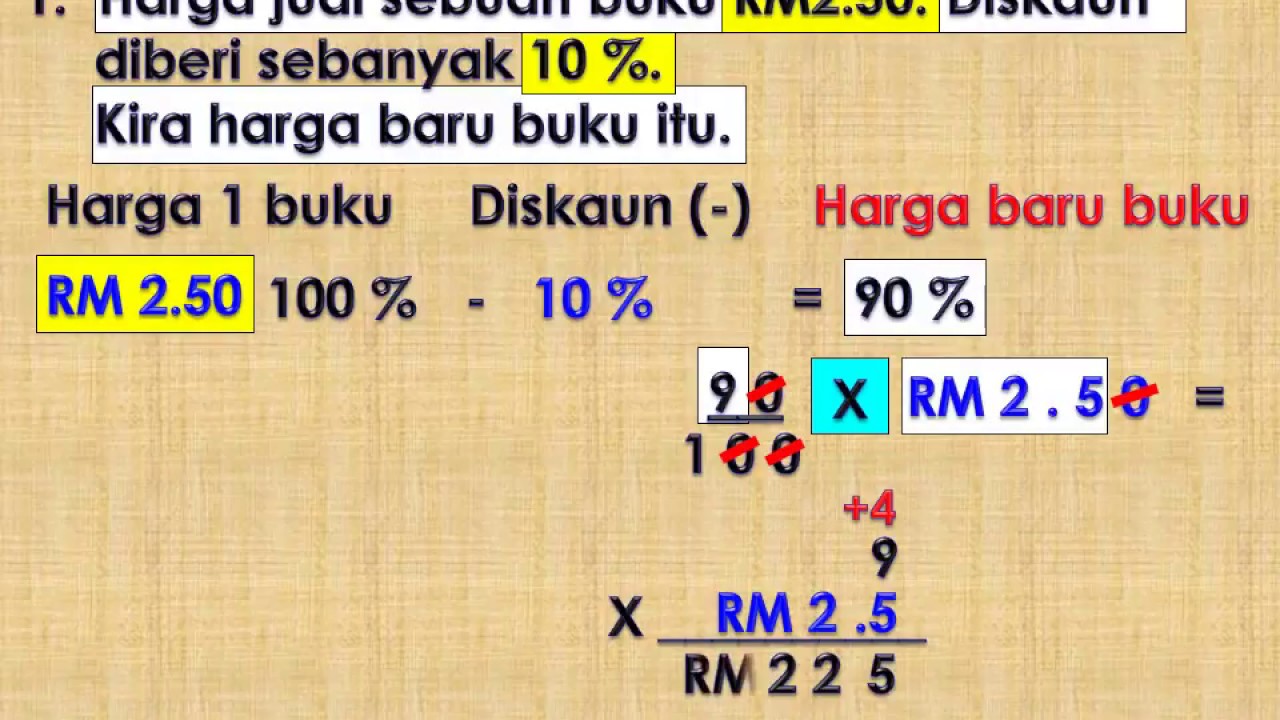

Cara Kira Peratus Dalam Excel Diskaun kira peratus | Taqueria Autentica

cara kira potongan cukai bulanan | Taqueria Autentica

Cara Nak Kira Peratus Gaji | Taqueria Autentica

Jimat Bayar Cukai Untuk Taksiran Berasingan | Taqueria Autentica

cara kira potongan cukai bulanan | Taqueria Autentica

Cara Kira Gaji Hari Mudahpayroll Pengiraan Gaji Bulanan Dalam Sebulan | Taqueria Autentica

Apa Maksud Potongan Cukai Berjadual (PCB)? | Taqueria Autentica

Cara Kira Pencen Bulanan Yang Akan Diterima Mengikut Gaji Akhir | Taqueria Autentica

Apa Maksud Potongan Cukai Berjadual (PCB)? | Taqueria Autentica

Pening Tengok Bil Elektrik? Ikut Je Cara Ni! | Taqueria Autentica

Cara Kira Rebat Cukai Dari Pembayaran Zakat | Taqueria Autentica

Rahasia Cara Daftar E Filing Mahkamah Terbaik | Taqueria Autentica

Kadar cukai individu pemastautin | Taqueria Autentica

Bajet 2023: Potongan cukai pendapatan, diskaun PTPTN, pengecualian duti | Taqueria Autentica