Effortless Compensation: Unlocking the Secrets of Accurate Payroll

In the intricate dance between employer and employee, few aspects hold the same weight as compensation. A company's success hinges on the dedication and talent of its workforce, and fair, accurate payment is paramount. But navigating the world of payroll can feel like traversing a labyrinth of regulations, deductions, and ever-changing variables. How can we ensure that the lifeblood of our businesses, our employees, are compensated accurately and transparently?

Understanding the nuances of calculating employee wages is essential for building trust and fostering a positive work environment. It's not merely about crunching numbers; it's about acknowledging the value each individual brings to the table. A clear, consistent approach to payroll fosters transparency, minimizes the risk of errors, and allows employees to focus on what truly matters – their contributions to the company's success.

The historical significance of fair compensation cannot be overstated. From the early days of bartering to the rise of organized labor, the quest for equitable pay has shaped societies and fueled revolutions. Today, with the rise of the gig economy and remote work, the conversation around employee compensation continues to evolve. We're grappling with new questions surrounding benefits, paid time off, and the very definition of "employee."

At the heart of this complex issue lie some fundamental truths. Employees deserve to be paid accurately and on time for the work they perform. Employers, in turn, need systems and processes that ensure compliance with labor laws, minimize financial risk, and uphold their ethical obligations. Achieving this balance requires a deep understanding of the factors that influence employee wages.

Whether you're a seasoned HR professional or a small business owner managing payroll for the first time, staying informed about best practices and legal requirements is essential. By embracing transparency, investing in the right tools, and prioritizing employee understanding, we can create a workplace where everyone feels valued and respected for their contributions.

Advantages and Disadvantages of Manual Payroll Calculation

| Advantages | Disadvantages |

|---|---|

| Cost-effective for small businesses with few employees | Time-consuming and prone to errors, especially with complex payroll components |

| Greater control over payroll data and calculations | Requires in-depth knowledge of tax regulations and deductions, increasing the risk of compliance issues |

Mastering the art of payroll is an ongoing journey. By embracing technology, seeking expert advice, and prioritizing open communication with your employees, you can create a compensation system that is fair, efficient, and reflective of your company's values. Remember, investing in your employees' financial well-being is an investment in the future of your business.

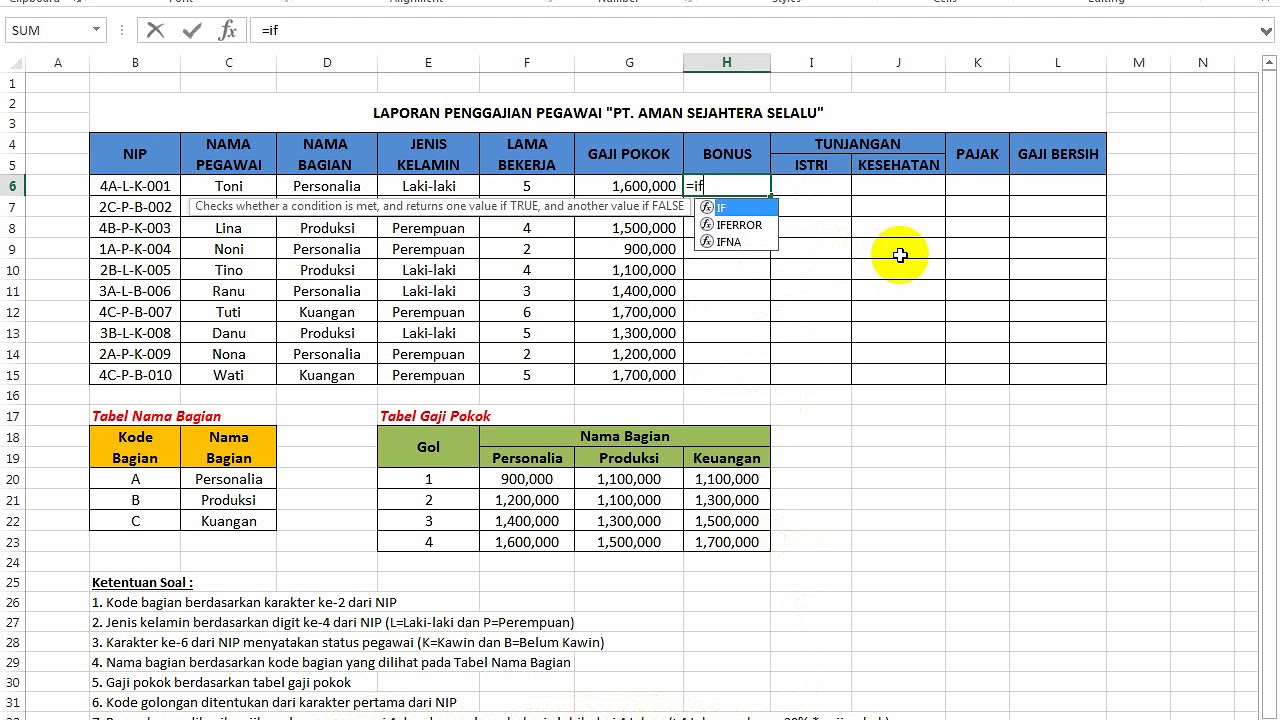

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica

bagaimana cara menghitung gaji karyawan | Taqueria Autentica