Say Goodbye to Lines: Your Guide to Endorsing Checks for Mobile Deposit

Remember the days of racing to the bank before closing time, just to deposit a single check? Thankfully, those days are long gone, thanks to the magic of mobile deposit. Now, we can deposit checks from the comfort of our couch, in our pajamas, with just a few taps on our phones. But before you snap that check pic, there's one crucial step: endorsing it correctly for mobile deposit.

It might seem like a small detail, but that little signature on the back of your check acts as your digital handshake, authorizing your bank to process the funds. Without it (or with an incorrect endorsement), your deposit could be delayed or even rejected. And nobody wants to deal with that kind of financial hiccup.

So, let's dive into the world of mobile check endorsements and make sure you're equipped to navigate it like a pro. We'll cover everything from the basic requirements to insider tips, ensuring your next mobile deposit is smooth sailing.

Before mobile banking took the world by storm, endorsing a check was pretty straightforward. You'd simply sign your name on the back, maybe scribble in an account number if you were feeling fancy, and that was that. But mobile deposit, with all its convenience, has added a little twist to the endorsement game.

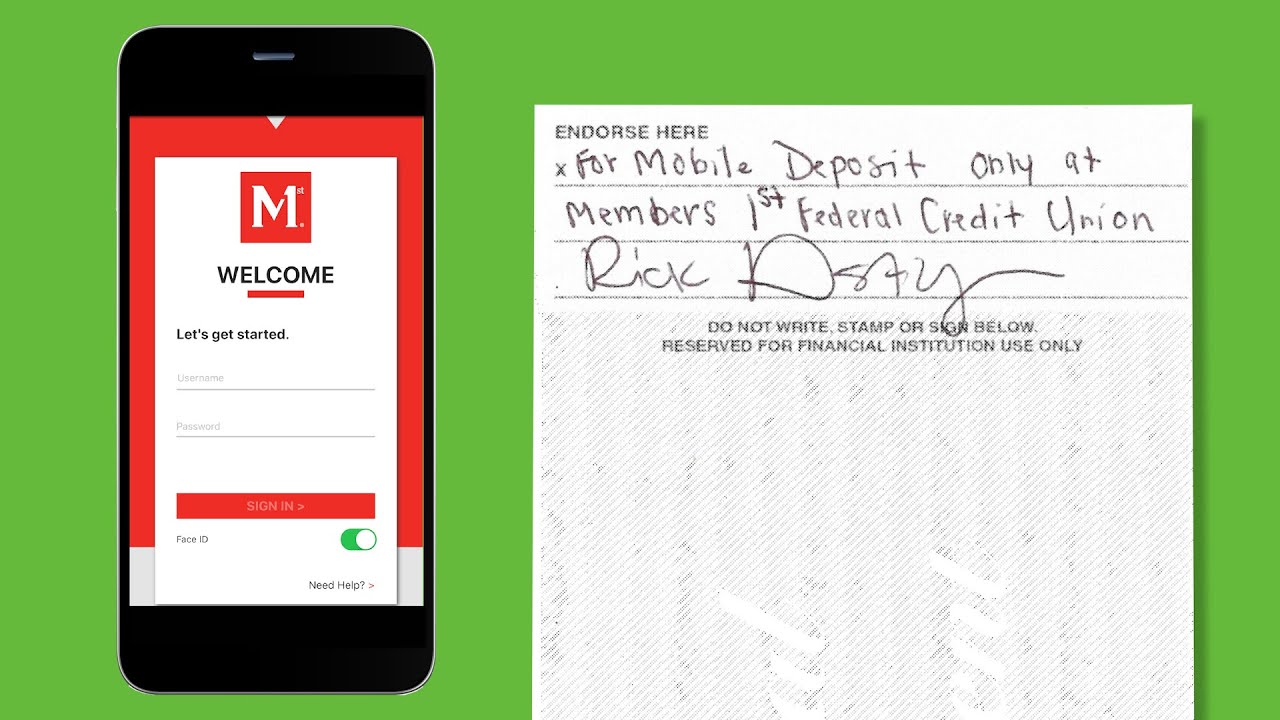

Now, along with your signature, you'll often need to add a specific phrase: "For mobile deposit." This tells the bank that you're giving permission for this particular check to be processed digitally, rather than in person. It's a small addition with a big impact, adding an extra layer of security to your transactions.

Advantages and Disadvantages of Mobile Check Deposit

| Advantages | Disadvantages |

|---|---|

| Convenience: Deposit checks anytime, anywhere. | Potential for delays: Technical issues or incorrect endorsements can slow down processing time. |

| Time-saving: Skip the trip to the bank and those dreaded lines. | Deposit limits: Some banks have restrictions on the amount or number of checks you can deposit daily or monthly. |

| Faster access to funds: Deposits are often processed quicker than traditional methods. | Security concerns: While generally safe, mobile deposit does carry a slight risk of fraud if not done carefully. |

While most banks require the "For mobile deposit" endorsement, it's always best to double-check their specific guidelines. Some banks might have slightly different instructions, and you don't want a simple oversight to turn into a banking headache.

Best Practices for Smooth Mobile Check Deposits:

Ready to become a mobile deposit master? Follow these best practices to ensure your transactions are always hassle-free:

- Read the Fine Print: Before you start snapping those check selfies, take a minute to familiarize yourself with your bank's mobile deposit rules. They'll outline everything from endorsement requirements to deposit limits.

- Double-Check Your Work: Once you've endorsed your check, give it a quick once-over to make sure everything is legible and in the right place.

- Light It Up: Good lighting is your best friend when it comes to mobile deposits. Natural light is ideal, but if you're snapping indoors, find a well-lit spot to avoid blurry photos.

- Keep It Steady: Nobody's expecting professional photography skills, but try to keep your hand as steady as possible when taking your check photo. A clear, focused image will make the processing smoother.

- Hold onto Your Check (for Now): While it's tempting to toss that check in the recycling bin immediately after deposit, most banks recommend holding onto it for a few days just in case any issues arise.

Mastering the art of the mobile check deposit might seem like a small victory, but it's these little tech triumphs that make modern life a little bit brighter. So go forth, embrace the future of banking, and bid farewell to those bank lines – your couch is waiting!

How to Endorse a Check for Mobile Deposit | Taqueria Autentica

Important Change to Mobile Deposit | Taqueria Autentica

Exactly Why Do We Still Have to Endorse Checks for Deposit? | Taqueria Autentica

how to endorse for mobile deposit | Taqueria Autentica

Everything You Need to Know About Cashing a Third Party Check | Taqueria Autentica

How Do I Endorse A Check To Chase Mobile Deposit: Step | Taqueria Autentica

how to endorse for mobile deposit | Taqueria Autentica

How To Endorse a Check for Mobile Deposit | Taqueria Autentica

How to Endorse a Check for Mobile Deposit | Taqueria Autentica

how do i endorse a check to chase mobile deposit | Taqueria Autentica

Where Can I Cash a Third Party Check? | Taqueria Autentica

What is Navy Federal mobile deposit limit? Leia aqui: What is the | Taqueria Autentica

how to endorse for mobile deposit | Taqueria Autentica

Get Your Funds Faster With Chase Mobile Check Deposits | Taqueria Autentica

how to endorse for mobile deposit | Taqueria Autentica