Streamline Your Business: The Power of Payment Authorization

In today's fast-paced digital economy, businesses are constantly seeking ways to optimize their operations and enhance customer experience. One crucial aspect of this optimization lies in ensuring seamless and secure payment processing. This is where payment authorization emerges as a critical process, acting as a safeguard for both businesses and consumers.

Simply put, payment authorization is the process of verifying whether a customer has sufficient funds available to cover a transaction before it is finalized. This verification process involves communication between the merchant, the customer's financial institution, and various payment processors, all happening within seconds to ensure a smooth checkout experience.

The history of payment authorization is closely intertwined with the evolution of payment methods themselves. From the early days of paper checks and credit card imprints to the rise of online shopping and mobile payments, the need for a secure and efficient way to validate transactions has been paramount. As technology advanced and payment methods became more sophisticated, so too did the authorization process, incorporating encryption, tokenization, and other security measures to protect sensitive financial data.

The importance of payment authorization cannot be overstated. For businesses, it mitigates the risk of fraud, chargebacks, and non-payment, safeguarding their revenue streams and reputation. For consumers, it provides peace of mind knowing that their financial information is secure and that they will not be held liable for unauthorized transactions. Moreover, a streamlined authorization process contributes to a positive customer experience, encouraging repeat business and fostering trust.

However, despite its numerous benefits, payment authorization is not without its challenges. Technical glitches, network outages, and the ever-present threat of fraud can all disrupt the process, leading to declined transactions, frustrated customers, and lost revenue. This underscores the need for businesses to partner with reliable payment processors, implement robust security measures, and stay informed about the latest industry trends and best practices.

Advantages and Disadvantages of Payment Authorization

| Advantages | Disadvantages |

|---|---|

| Reduced risk of fraud and chargebacks | Potential for declined transactions due to technical issues |

| Increased revenue security and predictability | Integration complexity with existing systems |

| Improved customer experience and trust | Dependency on third-party providers |

Best Practices for Implementing Payment Authorization

1. Choose a Reliable Payment Processor: Partner with a reputable payment processor that offers robust security features, multiple integration options, and responsive customer support.

2. Implement Strong Security Measures: Utilize encryption, tokenization, and other security protocols to protect sensitive customer data during the authorization process.

3. Offer Multiple Payment Options: Provide customers with a variety of payment options, including credit cards, debit cards, mobile wallets, and alternative payment methods, to enhance convenience and flexibility.

4. Optimize Your Checkout Process: Simplify your checkout process to reduce friction and minimize the likelihood of abandoned carts. Ensure a clear and concise presentation of payment information and offer guest checkout options.

5. Monitor and Analyze Authorization Rates: Regularly track your authorization rates and investigate any significant fluctuations. Identify and address any potential bottlenecks or issues that may be impacting transaction approvals.

In conclusion, payment authorization plays a pivotal role in facilitating secure and seamless transactions in today's digital landscape. By understanding the process, its benefits, and best practices, businesses can mitigate risks, optimize revenue streams, and cultivate trust with their customers. As technology continues to evolve, embracing innovation and prioritizing security will be paramount in ensuring the continued success of payment authorization in the years to come.

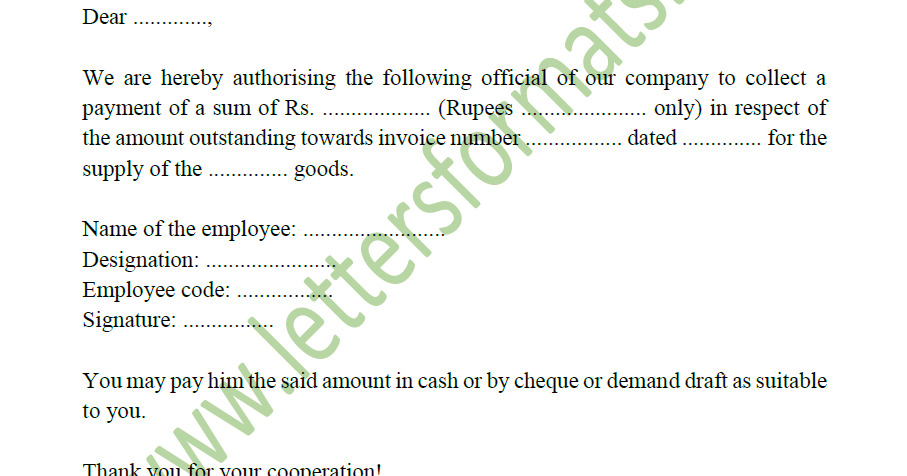

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

Resignation Of Power Of Attorney Template | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

authorization to collect payment | Taqueria Autentica

Who Can Draft Power Of Attorney | Taqueria Autentica