The Invisible Threads: Unraveling the Significance of Wells Fargo Customer Email

In the bustling tapestry of modern life, where information travels at the speed of light, communication forms the very threads that hold us together. Among these threads, email, despite its seemingly antiquated nature, remains a potent force, particularly in our interactions with the institutions that shape our financial lives. For patrons of Wells Fargo, one of America's largest financial institutions, the Wells Fargo customer email channel represents a vital lifeline, facilitating a myriad of transactions, inquiries, and resolutions.

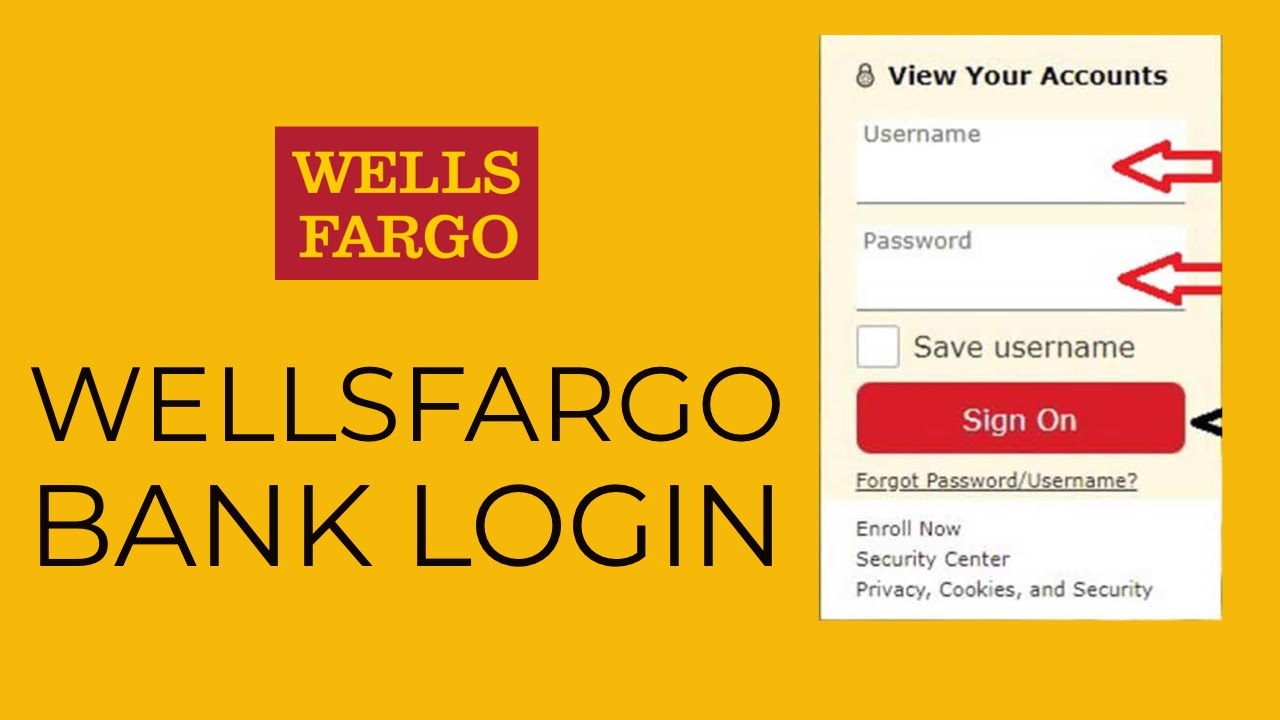

Imagine this: you're nestled in a cozy armchair, a steaming cup of tea warming your hands, when suddenly you remember a crucial financial task. Perhaps you need to update your contact information, inquire about a recent transaction, or simply seek clarification on a specific service. In this moment, the Wells Fargo customer email becomes more than just an electronic mailbox; it transforms into a portal, a direct line of communication to the heart of your financial world.

The history of Wells Fargo customer email is intricately woven with the evolution of digital communication itself. As email emerged from the nascent stages of the internet and blossomed into a ubiquitous form of correspondence, financial institutions like Wells Fargo recognized its potential to revolutionize customer service. Gone were the days of relying solely on snail mail, phone calls, or in-person visits to branches. Email ushered in an era of unparalleled convenience, allowing customers to connect with their banks at any time, from anywhere in the world.

This shift towards digital communication, however, was not without its growing pains. As the volume of Wells Fargo customer emails surged, so too did the challenges of managing this influx effectively. Concerns about privacy, security, and the timely resolution of customer inquiries came to the forefront. The need for robust systems to handle email volume, authenticate customer identities, and ensure the confidentiality of sensitive financial information became paramount.

Today, Wells Fargo, like many other financial institutions, employs sophisticated technologies and protocols to safeguard customer email communications. Encryption methods protect sensitive data as it traverses the digital realm, while rigorous authentication processes verify the identities of both senders and recipients. These measures are crucial not only for protecting customers' financial well-being but also for maintaining the trust that forms the bedrock of any successful financial institution.

While the evolution of Wells Fargo customer email has encountered its share of complexities, the benefits it offers are undeniable. Imagine, for instance, the peace of mind that comes with receiving instant email notifications about account activity, alerting you to potential fraud or simply keeping you informed about your financial status. Consider the convenience of being able to forward important documents, such as statements or tax forms, with just a few clicks. And let's not forget the sheer time-saving aspect of resolving account inquiries or initiating transactions without the need for time-consuming phone calls or branch visits.

In essence, the Wells Fargo customer email channel represents a bridge between the tangible world of finance and the ever-expanding digital landscape. It empowers customers by granting them greater control over their financial lives and provides a direct line of communication to a team of professionals dedicated to assisting them. As we navigate an increasingly digital world, understanding the nuances of this communication channel becomes ever more crucial.

Advantages and Disadvantages of Wells Fargo Customer Email

| Advantages | Disadvantages |

|---|---|

| Convenience and Accessibility | Security Risks |

| Documentation and Record-Keeping | Potential for Miscommunication |

| Efficient Communication | Response Time Delays |

While Wells Fargo continues to refine and enhance its customer email system, it remains an essential tool for managing your financial well-being. By understanding its history, benefits, and best practices, you can navigate the intricacies of digital communication with greater confidence and ensure a seamless and secure banking experience.

Wells Fargo Email Virus | Taqueria Autentica

Wells Fargo Fraud Detection Email or Letter | Taqueria Autentica

Wells Fargo Acceptance Letter 2011 | Taqueria Autentica

wells fargo customer email | Taqueria Autentica

Wells Fargo agrees to pay $1 billion to settle customer abuse claims | Taqueria Autentica

Is the Wells Fargo Alert Update a legitimate email? | Taqueria Autentica

wells fargo customer email | Taqueria Autentica

Wells Fargo Bank Reference Letter | Taqueria Autentica

Wells Fargo Federal Reserve Sanction Turns 5. When Will It End? | Taqueria Autentica

Troubleshooting Wells Fargo Online Bill Pay Issues | Taqueria Autentica

wells fargo customer email | Taqueria Autentica

Beware the Wells Fargo Phishing Scam Scam! | Taqueria Autentica

Wells Fargo pays $575 million to settle state investigations | Taqueria Autentica

Wells Fargo Email Virus | Taqueria Autentica

Online Wire Limit Wells Fargo at Rodney Maddux blog | Taqueria Autentica