Understanding Borang Potongan Zakat MAIK and its Significance

In many Muslim-majority countries, the concept of Zakat holds immense religious and societal importance. It's one of the five pillars of Islam, emphasizing the significance of wealth distribution and social responsibility. Malaysia, with its diverse population and cultural richness, has a well-established system for Zakat collection and distribution. A key element facilitating this process is the "Borang Potongan Zakat MAIK," a form crucial for understanding and fulfilling one's Zakat obligations.

While the term might sound technical, understanding its essence can be quite straightforward. In essence, "Borang Potongan Zakat MAIK" refers to the official deduction form used by the Majlis Agama Islam dan Adat Istiadat Melayu Kelantan (MAIK), the religious council of the Kelantan state in Malaysia, to deduct Zakat from the salaries of Muslim employees. This form simplifies the process, making it easier for individuals to fulfill their religious duty and contribute to the well-being of the community.

The importance of Zakat in Islam cannot be overstated. It's not just a financial obligation; it's a spiritual practice that purifies wealth, promotes social justice, and uplifts the less fortunate. The "Borang Potongan Zakat MAIK" plays a crucial role in this context, providing a systematic and transparent method for Zakat collection and distribution, ensuring that it reaches those who need it most.

While the concept of Zakat is rooted in Islamic teachings, the implementation of deduction forms like the "Borang Potongan Zakat MAIK" is a practical approach adopted by various Islamic institutions to facilitate and streamline the Zakat payment process. This system ensures efficiency and accountability, benefiting both the Zakat payers and recipients.

Navigating the intricacies of religious practices can sometimes seem daunting, especially in a world brimming with information. However, understanding the fundamentals of "Borang Potongan Zakat MAIK" doesn't have to be complex. This article will delve deeper into the various aspects of this deduction form, its significance in the context of Zakat, and its broader impact on society. We'll also explore the practical aspects, providing you with the knowledge and resources to fulfill this essential religious obligation with ease.

Advantages and Disadvantages of the Zakat Deduction System (Similar to Borang Potongan Zakat MAIK)

While not specific to Borang Potongan Zakat MAIK, a general comparison of advantages and disadvantages of Zakat deduction systems can be helpful:

| Advantages | Disadvantages |

|---|---|

| Convenience for payers | Potential for errors in deductions |

| Regular and timely collection of Zakat | Limited flexibility in choosing Zakat recipients for those who prefer to donate directly |

| Transparency and accountability in Zakat distribution | May require additional administrative processes |

Understanding both the spiritual and practical aspects of Zakat is essential for every Muslim. The "Borang Potongan Zakat MAIK," while specific to Kelantan, represents a broader effort to simplify and streamline Zakat payments. By educating ourselves and fulfilling this important pillar of Islam, we contribute not just to our spiritual growth but also to a more equitable and just society.

Borang Potongan Zakat Maidam | Taqueria Autentica

Borang Kebenaran Potongan Gaji Salinan MAIK | Taqueria Autentica

Borang Potongan Gaji Bayar Zakat Format Melaka | Taqueria Autentica

Borang Permohonan Sewaan Premis MAIK | Taqueria Autentica

Borang zakat by SK Sultan Yussuf | Taqueria Autentica

borang potongan zakat maik | Taqueria Autentica

Skim Potongan Zakat Bulanan (PZB) | Taqueria Autentica

borang potongan zakat maik | Taqueria Autentica

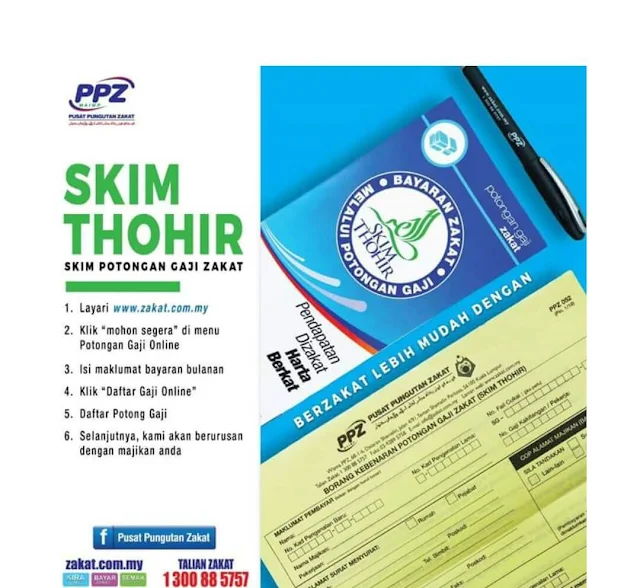

Kempen Skim Potongan Gaji Zakat (Skim Thohir) | Taqueria Autentica

BORANG POTONGAN ZAKAT MAJLIS AGAMA ISLAM JOHOR (MAIJ) FORMAT B | Taqueria Autentica