Understanding Overtime Calculations for Government Employees

Navigating the world of employment law can feel like traversing a complex labyrinth, especially when it comes to overtime regulations. This holds particularly true for government employees, where specific rules and formulas dictate how overtime pay is calculated. Understanding these regulations is not just crucial for employers to ensure legal compliance, but also for employees to advocate for their rights and guarantee they receive fair compensation for their hard work.

While this article provides a general overview of overtime calculations, it’s important to note that specific rules can vary based on factors like the employee's job classification, the government agency they work for, and collective bargaining agreements. Always refer to official government resources and consult with HR professionals for the most accurate and up-to-date information.

The concept of overtime pay stems from the principle of fair compensation for work exceeding the standard hours. Just like in the private sector, government employees are generally entitled to overtime pay when they work beyond their regular working hours. This ensures that employees are rewarded for their additional time and effort, while also discouraging employers from overworking their staff without appropriate compensation.

Historically, the push for fair labor standards, including overtime regulations, gained momentum during the early 20th century. This led to the establishment of labor laws that aimed to protect workers from exploitation and ensure decent working conditions. These regulations have evolved over time, reflecting changing work patterns and the need for a balance between employee well-being and organizational efficiency.

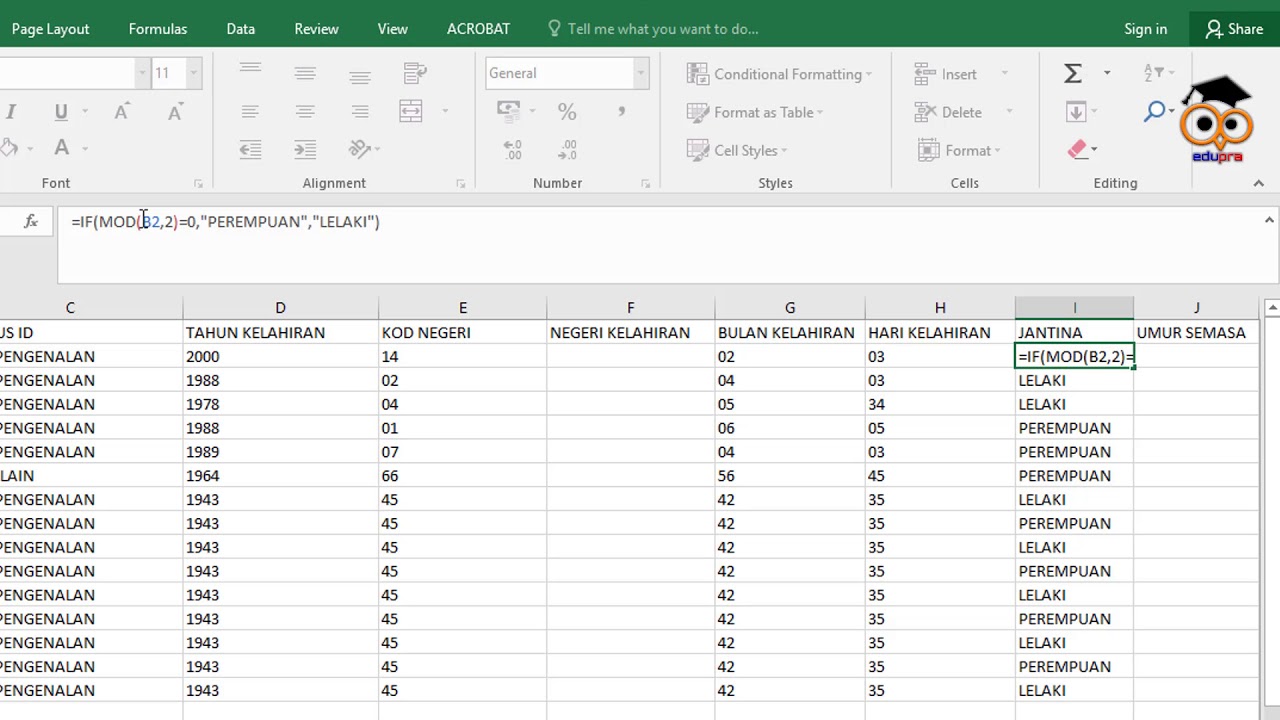

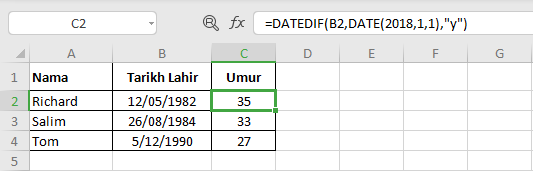

One of the main issues surrounding overtime calculations for government employees is the complexity of the formulas involved. Unlike a simple time-and-a-half calculation, various factors can come into play, such as different overtime rates for weekends, public holidays, or work performed during specific timeframes. This complexity can lead to confusion and potential discrepancies in overtime payments if not handled correctly.

Advantages and Disadvantages of Specific Overtime Calculation Methods

Let's delve into the advantages and disadvantages of different methods sometimes used in overtime calculations:

| Method | Advantages | Disadvantages |

|---|---|---|

| Hourly Rate Calculation | Simple, transparent, easy to understand. | May not accurately reflect compensation for irregular work schedules or specific job duties. |

| Weighted Average Calculation | Suitable for employees with varying pay rates due to different tasks. | Can be complex to calculate and may be harder for employees to understand. |

While specific formulas and regulations vary, understanding the core principles of overtime calculation is crucial for both employers and employees. By ensuring accurate calculations and transparent practices, government agencies can foster a culture of fairness and trust, while employees can feel confident that they are being compensated appropriately for their contributions.

formula kiraan ot kerajaan | Taqueria Autentica

Cara Kira Overtime Terkini (Pindaan Akta Kerja 2022) | Taqueria Autentica

formula kiraan ot kerajaan | Taqueria Autentica

formula kiraan ot kerajaan | Taqueria Autentica

Waktu Bekerja & Cara Kira Gaji Lebih Masa | Taqueria Autentica

Cara Kira Overtime Terkini (Pindaan Akta Kerja 2022) | Taqueria Autentica

formula kiraan ot kerajaan | Taqueria Autentica

formula kiraan ot kerajaan | Taqueria Autentica

formula kiraan ot kerajaan | Taqueria Autentica

Contoh Pengiraan Kerja Lebih Masa | Taqueria Autentica

formula kiraan ot kerajaan | Taqueria Autentica

formula kiraan ot kerajaan | Taqueria Autentica

Senarai Cuti Am Yang Wajib Diambil Majikan & Cara Kira Overtime | Taqueria Autentica

Cara Kira Gaji Bulanan Pekerja | Taqueria Autentica

formula kiraan ot kerajaan | Taqueria Autentica