Understanding Payroll Frequency: A Guide for Businesses and Employees

Determining the right payroll frequency is a crucial aspect of managing a business and maintaining a satisfied workforce. While it might seem like a simple operational detail, the frequency at which employees receive their salaries can significantly impact employee morale, budgeting, and even legal compliance. This is especially true in Indonesia, where the term "pembagian gaji berapa hari per bulan" (salary distribution how many days per month) is a common query, highlighting the importance of this topic.

Choosing the right payroll schedule is about finding a balance that works for both the employer and the employees. Some businesses may opt for a more frequent payroll schedule, such as weekly or bi-weekly, while others might find a monthly or semi-monthly payroll more manageable. Factors influencing this decision include company size, industry norms, employee preferences, and legal requirements.

Imagine a small startup with limited cash flow. They might choose a monthly payroll to better manage their expenses. Conversely, a large manufacturing company with numerous hourly workers might opt for a weekly payroll to ensure their employees receive timely compensation for their work. Understanding the nuances of different payroll frequencies is essential for businesses to make informed decisions that align with their specific needs and legal obligations.

Furthermore, transparency in payroll practices is key. Employees need to understand when and how they will be compensated, as this directly affects their personal budgeting and financial planning. Clear communication regarding payroll frequency, payment methods, and any applicable deductions helps build trust and avoid potential misunderstandings down the line.

This guide delves deeper into the intricacies of payroll frequency, exploring its historical evolution, the importance of understanding local labor laws, the different types of payroll schedules, and the benefits and challenges associated with each. We'll also provide actionable tips for both employers and employees to navigate the complexities of payroll and ensure a smooth and efficient process.

Advantages and Disadvantages of Different Payroll Frequencies

Choosing the right payroll frequency is a crucial decision for any business. It impacts employee satisfaction, financial planning, and administrative workload. Here's a breakdown of the advantages and disadvantages of different payroll frequencies:

| Payroll Frequency | Advantages | Disadvantages |

|---|---|---|

| Weekly |

|

|

| Bi-weekly |

|

|

| Monthly |

|

|

Best Practices for Implementing Payroll

Effectively managing payroll is crucial for maintaining accurate financial records and ensuring employee satisfaction. Here are five best practices for businesses to implement:

- Choose the Right Payroll System: Select a payroll software or service that aligns with your business needs and size. Consider factors like ease of use, integration with existing systems, and automation capabilities.

- Stay Compliant with Labor Laws: Keep abreast of local labor laws regarding minimum wage, overtime pay, and mandatory deductions. Ensure your payroll system is updated to reflect these regulations.

- Maintain Accurate Employee Records: Keep thorough records of employee information, including tax forms, salary details, and attendance. This ensures accurate payroll processing and simplifies tax filing.

- Communicate Transparently with Employees: Clearly communicate payroll policies, including payment dates, deductions, and any changes to the payroll process. Provide employees access to their pay stubs and address any payroll-related queries promptly.

- Regularly Review and Audit Payroll: Conduct periodic audits to identify and rectify any errors in payroll calculations, tax deductions, or employee information. This helps maintain accuracy and compliance.

Frequently Asked Questions about Payroll

Here are answers to some commonly asked questions regarding payroll:

- What is gross pay? Gross pay is the total amount an employee earns before any deductions, such as taxes, insurance premiums, or retirement contributions. It includes regular wages, overtime pay, bonuses, and other forms of compensation.

- What is net pay? Net pay, also known as take-home pay, is the amount an employee receives after all deductions are withheld from their gross pay. This is the actual amount deposited into their bank account.

- What are common payroll deductions? Common payroll deductions include income tax, social security contributions, Medicare taxes, health insurance premiums, retirement plan contributions, and wage garnishments.

- What is a pay stub? A pay stub is a document provided to employees with each paycheck, outlining their earnings, deductions, and net pay for a specific pay period. It serves as a record of their payment history.

- What should I do if there's an error in my paycheck? If you notice an error in your paycheck, report it to your employer or the HR department immediately. They are responsible for investigating and rectifying any payroll discrepancies.

- How often should payroll be processed? The frequency of payroll processing depends on various factors, such as company policy, employee preferences, and legal requirements. Common payroll frequencies include weekly, bi-weekly, semi-monthly, and monthly.

- What are the benefits of using payroll software? Payroll software automates payroll processes, reduces the risk of errors, simplifies tax calculations and filings, and saves time and resources for businesses.

- How can I learn more about payroll regulations? You can find comprehensive information on payroll regulations and best practices from reputable sources such as the Internal Revenue Service (IRS), the U.S. Department of Labor, and professional payroll associations.

Conclusion

Understanding and implementing a suitable payroll system is paramount for any business, regardless of its size or industry. It ensures employees are paid accurately and on time, which is crucial for maintaining morale and productivity. By adhering to local labor laws, choosing the right payroll frequency, and implementing best practices, businesses can streamline their payroll processes and create a positive work environment. Remember, a well-managed payroll system benefits both the employer and the employees, contributing to a harmonious and successful working relationship. It's an investment worth making for the long-term health and growth of your business.

pembagian gaji berapa hari per bulan | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica

Agar Tetap Bugar , Ini Cara Minum Air Putih Saat Puasa | Taqueria Autentica

5 Tips Menabung 100 Juta dalam Setahun, Beneran Bisa? | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica

+(1).jpg)

pembagian gaji berapa hari per bulan | Taqueria Autentica

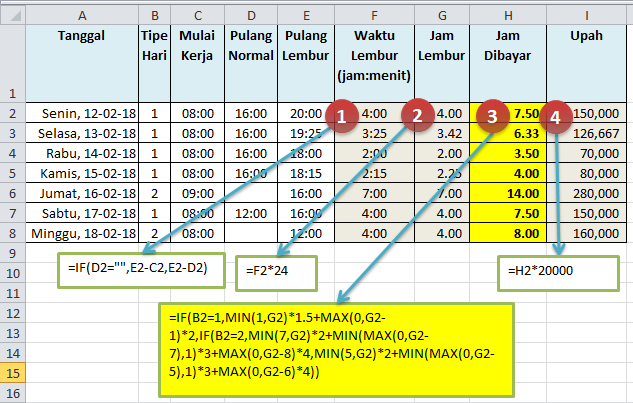

Rumus Perhitungan Lembur Karyawan | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica

pembagian gaji berapa hari per bulan | Taqueria Autentica