Unleash Your Financial Power: Conquering "Contoh Surat Rekomendasi Pinjaman Ke Bank"

Ever felt like the financial world throws curveballs you weren't prepared for? You're not alone. One minute you're dreaming of a life upgrade - a new business venture, a home renovation, maybe even that epic cycling trip across Europe. The next, you're facing a mountain of paperwork, confusing financial jargon, and let's not forget the dreaded loan application process.

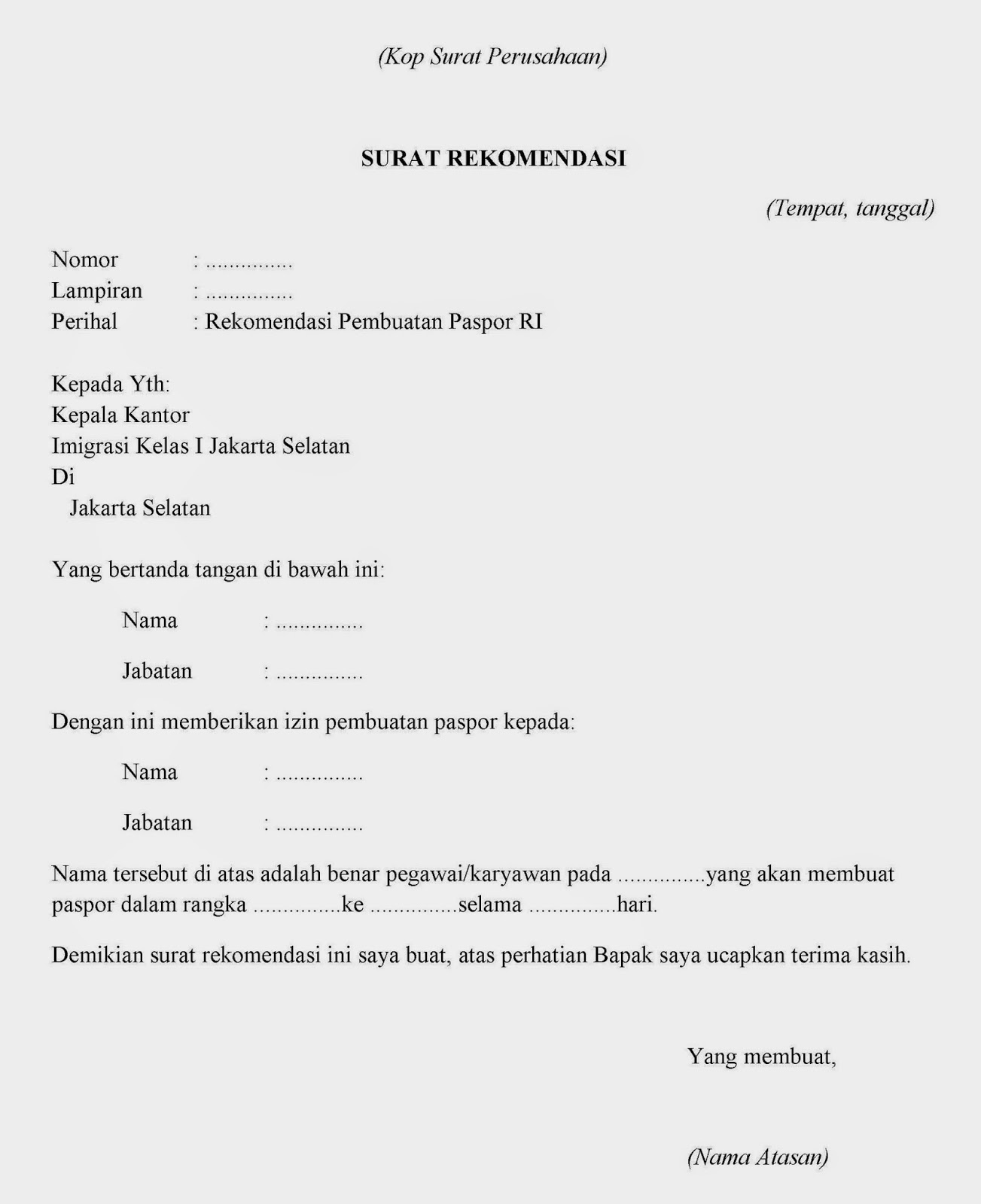

Here's the good news: you have more control than you think. One often-overlooked secret weapon? A solid "contoh surat rekomendasi pinjaman ke bank," which translates to "loan recommendation letter" for those who haven't mastered Indonesian (yet!). This little document can be the difference between a "yes" and a "we'll think about it" (which, let's be honest, usually means no) from your bank.

Now, you might be thinking, "A recommendation letter? That's for college applications, right?". Not so fast! In the world of loans, a strong recommendation letter adds weight to your application, showcasing your credibility and trustworthiness to the bank. Think of it as a character reference for your financial life.

This isn't just about ticking boxes; it's about building trust and proving you're serious about managing your finances responsibly. After all, banks are more likely to lend you money when they're confident you'll pay it back, right? That's where a well-crafted recommendation letter can truly shine.

Ready to unlock the power of the "contoh surat rekomendasi pinjaman ke bank" and take charge of your financial future? Let's break down everything you need to know, from its significance to crafting a compelling letter that gets results.

Imagine this: you're about to embark on a thrilling adventure, but there's a formidable gatekeeper barring the way. That's essentially what applying for a loan can feel like, especially when it comes to securing significant funding for life-changing endeavors. The "contoh surat rekomendasi pinjaman ke bank," often underestimated, is your key to persuading this gatekeeper – the bank – to open the doors to your financial aspirations.

This letter, a testament to your financial responsibility and trustworthiness, provides the bank with an external perspective on your ability to manage the loan effectively. While financial documents showcase your numbers, this letter adds a human touch, painting a picture of your character and commitment to fulfilling your financial obligations.

Mastering the art of securing a strong recommendation letter requires understanding its nuances. In the following sections, we'll delve deeper into the specific elements that constitute an effective "contoh surat rekomendasi pinjaman ke bank," empowering you to navigate the intricacies of the loan application process with confidence and finesse.

Advantages and Disadvantages of a Strong Loan Recommendation Letter

| Advantages | Disadvantages |

|---|---|

| Enhances credibility and trustworthiness in the eyes of the lender | Relies on finding a suitable recommender who can vouch for your financial responsibility |

| Provides a personal touch, supplementing financial documents | Effectiveness depends on the recommender's reputation and the quality of the letter |

| Can strengthen loan applications, increasing chances of approval | Might not be a mandatory requirement, potentially leading to wasted effort if not needed |

5 Best Practices for a Stellar "Contoh Surat Rekomendasi Pinjaman Ke Bank"

1. Choose Your Recommender Wisely: Opt for someone who knows you well and can vouch for your financial responsibility. This could be a current or former employer, a respected professional, or even a long-standing client.

2. Provide Clear Instructions: Don't leave your recommender in the dark! Explain the purpose of the loan, the amount you're seeking, and how the letter will be used.

3. Emphasize Relevant Qualities: Highlight your strong work ethic, financial discipline, and commitment to meeting your obligations. A personal anecdote illustrating these traits can leave a lasting impression.

4. Keep it Concise and Professional: Get straight to the point and avoid rambling. Use a formal tone, proper grammar, and clear formatting.

5. Proofread Meticulously: Typos and grammatical errors can undermine your credibility. Have a fresh pair of eyes review the letter before submission.

8 Common Questions and Answers

1. What is "contoh surat rekomendasi pinjaman ke bank"?

It's an Indonesian term for "loan recommendation letter," a document supporting your loan application by vouching for your character and financial responsibility.

2. Who should I ask to write my loan recommendation letter?

Choose someone who knows you well and can speak to your financial reliability, such as an employer, mentor, or long-term client.

3. What should be included in the letter?

The letter should clearly state the recommender's relationship with you, highlight your positive qualities and financial responsibility, and express their confidence in your ability to repay the loan.

4. How long should the letter be?

Aim for a concise and impactful letter, ideally within one page.

5. Can I use a template for the letter?

While templates can be helpful, personalize the letter to reflect your unique situation and your relationship with the recommender.

6. When should I submit the letter?

Follow the bank's instructions on submission. Some might require it with the initial application, while others may request it later in the process.

7. Is a recommendation letter always required for a loan?

Not always. Check the specific requirements of the loan you're applying for, as it may not be mandatory.

8. What if I can't find someone to write me a recommendation letter?

If finding a recommender proves challenging, explore alternative ways to strengthen your application, such as providing additional financial documentation or offering a larger down payment.

Tips and Tricks for "Contoh Surat Rekomendasi Pinjaman Ke Bank" Success

- Timing is Key: Don't wait until the last minute to request the letter. Give your recommender ample time to craft a thoughtful response.

- Express Gratitude: Always thank your recommender for their time and effort, regardless of the loan outcome.

- Follow Up (Politely): If you haven't heard back from your recommender within a reasonable timeframe, it's okay to send a gentle reminder.

Navigating the world of loans and financial jargon can feel like learning a new language. But remember, knowledge is power. By understanding the power of a well-crafted "contoh surat rekomendasi pinjaman ke bank," you're taking control of your financial journey and increasing your chances of securing the resources you need to achieve your goals. So, go forth, gather your financial allies, and craft a compelling letter that opens doors to a brighter financial future!

Contoh Surat Rekomendasi Atasan | Taqueria Autentica

Surat Permohonan Ke Bank | Taqueria Autentica

Contoh Surat Rekomendasi Pinjaman Ke Bank | Taqueria Autentica

Contoh Surat Rekomendasi Pinjaman Uang | Taqueria Autentica

Contoh Surat Rekomendasi Pinjaman Dari Kepala Sekolah | Taqueria Autentica

Contoh Surat Rekomendasi Kir | Taqueria Autentica

Contoh Surat Pinjaman Uang 2 | Taqueria Autentica

Surat Permohonan Pelunasan Kredit Di Bank Bri | Taqueria Autentica

Contoh Surat Rekomendasi Kepala Sekolah Untuk Pinjaman Ke Bank | Taqueria Autentica

Download Contoh Surat Rekomendasi Beasiswa yang Benar dan Baik | Taqueria Autentica

Contoh Surat Rekomendasi Pinjaman Bank | Taqueria Autentica

contoh surat rekomendasi pinjaman ke bank | Taqueria Autentica

Contoh Surat Perjanjian Pinjaman Karyawan | Taqueria Autentica

Contoh Surat Rekomendasi Untuk Pinjaman Ke Bank | Taqueria Autentica

Contoh Surat Rekomendasi Pinjaman Dari Atasan | Taqueria Autentica