Unlocking Financial Blessings: Understanding Zakat Calculation on Monthly Income

Imagine this: you've worked hard, managed your finances well, and now you're enjoying a comfortable monthly income. But have you ever considered the concept of "zakat" and its implications on your earnings? In Islam, zakat is one of the five pillars, a fundamental act of worship that goes beyond prayer and fasting. It's about sharing your wealth with those in need, purifying your wealth, and ensuring a more just and equitable society.

Now, you might be thinking, "Zakat? That's for people with significant assets, right?" Not necessarily! While zakat is typically associated with assets like gold, silver, and agricultural produce, it's equally applicable to your monthly income. This means that even if you're not a business tycoon or a landowner, your earnings have the potential to make a real difference in the lives of others.

Calculating zakat on your monthly income (often referred to as "cara pengiraan zakat pendapatan bulanan" in Malay) might seem daunting at first, but it's actually a straightforward process. And trust us, the spiritual and societal rewards far outweigh any perceived complexities. By understanding the principles and mechanisms behind zakat calculation, you're not just fulfilling a religious obligation, but also embarking on a journey of financial responsibility, social consciousness, and spiritual growth.

In many Muslim-majority countries, you'll find dedicated zakat collection and distribution centers. These institutions often provide clear guidelines and resources to help individuals and families calculate and pay their zakat. However, regardless of where you live, understanding the fundamental principles behind "cara pengiraan zakat pendapatan bulanan" empowers you to manage this crucial aspect of your finances responsibly.

This article will guide you through the intricacies of zakat calculation on your monthly income. We'll delve into the historical context, explore the numerous benefits, and equip you with a practical, step-by-step guide to ensure you fulfill this essential pillar of Islam with confidence and ease.

Advantages and Disadvantages of Calculating Zakat on Monthly Income

While calculating zakat on a monthly basis is not a requirement in Islam, it can offer some benefits for certain individuals:

| Advantages | Disadvantages |

|---|---|

| Makes zakat more manageable by spreading it out over the year. | May be more complex to track if income fluctuates significantly. |

| Allows for consistent giving throughout the year, potentially benefiting recipients more regularly. | Could lead to overlooking potential zakat obligations on other assets if not careful. |

Best Practices for Calculating and Paying Zakat on Monthly Income

Here are some best practices to make the process smoother:

- Consult with a Religious Scholar: Seek guidance from a trusted Islamic scholar or imam to address any specific questions or concerns regarding zakat on your monthly income.

- Keep Accurate Records: Maintain detailed records of your monthly income and expenses to ensure accurate zakat calculation.

- Set Reminders: Consider setting up monthly reminders to calculate and pay your zakat, preventing it from being overlooked.

- Research Zakat Organizations: Explore reputable zakat collection and distribution organizations to ensure your contributions reach those in need effectively.

- Reflect on the Spiritual Significance: Remember that zakat is not merely a financial transaction, but a profound act of worship.

Calculating and paying zakat on your monthly income is an integral part of fulfilling your Islamic obligations and contributing to a more equitable society. By understanding the principles, embracing the process, and seeking knowledge from reliable sources, you can approach this essential pillar of Islam with confidence and clarity. Remember, zakat is not just about fulfilling a duty; it's about purifying your wealth, cultivating gratitude, and making a tangible difference in the lives of those less fortunate.

JADUAL POTONGAN PCB 2012 PDF | Taqueria Autentica

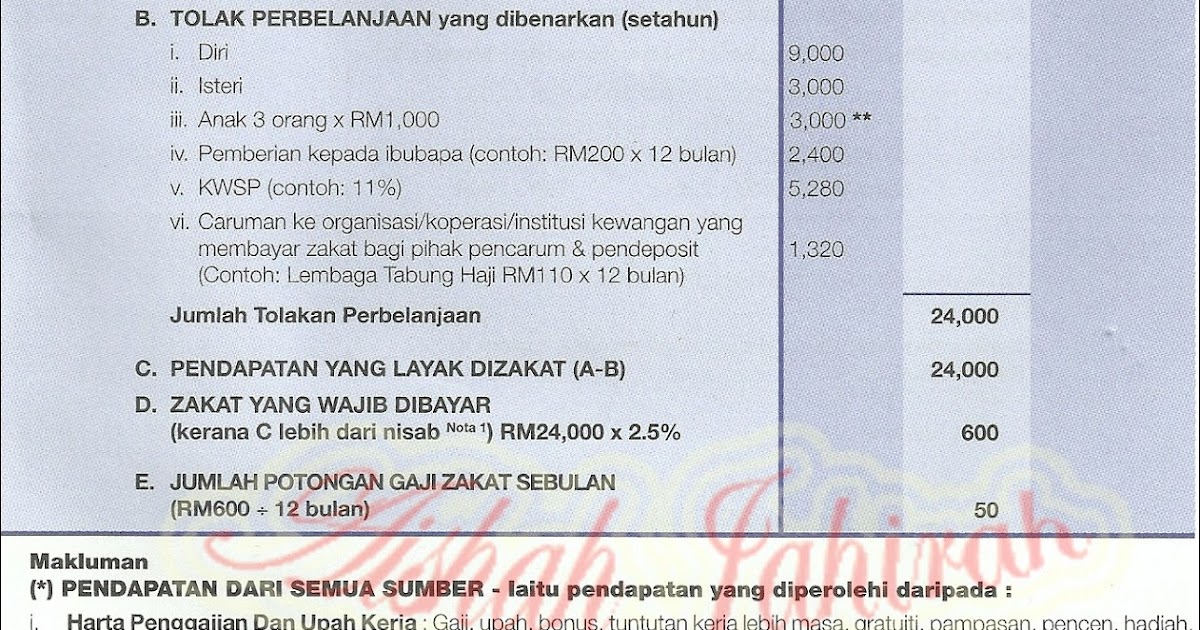

Cara Pengiraan Zakat Pendapatan dan Zakat Simpanan (2.5%) | Taqueria Autentica

cara pengiraan zakat pendapatan bulanan | Taqueria Autentica

Apa Itu Zakat Pendapatan dan Cara Pengiraan Zakat Pendapatan | Taqueria Autentica

Cara Mengamalkan Ayat Seribu Dinar Setelah Sholat Dhuha | Taqueria Autentica

Cara Pengiraan Zakat Pendapatan | Taqueria Autentica

Cara Kira Zakat Pendapatan | Taqueria Autentica

Kaedah Kiraan, Cara Bayar Zakat Simpanan di Malaysia 2024 | Taqueria Autentica

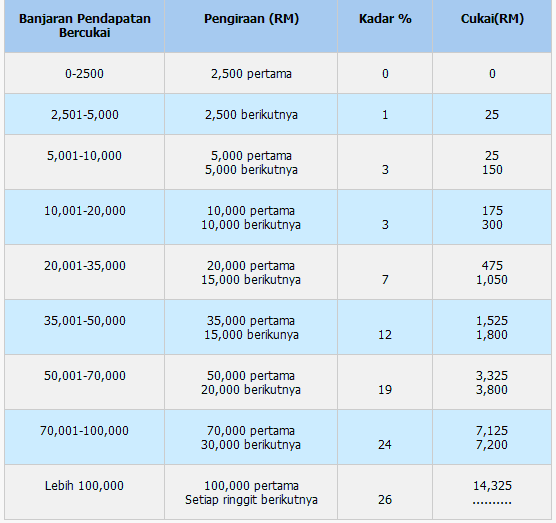

Kadar cukai individu pemastautin | Taqueria Autentica

Cara Kira Gaji Bulanan Pekerja | Taqueria Autentica

Berapa Harga Kereta Yang Sesuai Dengan Gaji Anda? Ini Cara Pengiraan | Taqueria Autentica

Panduan Lengkap Cara Isi eFiling Bagi Pengiraan Cukai Pendapatan | Taqueria Autentica

Cara Pengiraan Zakat Pendapatan dan Zakat Simpanan (2.5%) | Taqueria Autentica

Apa Itu Zakat Pendapatan dan Cara Pengiraan Zakat Pendapatan | Taqueria Autentica

Cara Pengiraan Gaji Bulanan Pengiraan Jumlah Pencen Bulanan Yang | Taqueria Autentica