Unlocking the Power of Seven: Mastering the Art of Spent

Have you ever felt the weight of a depleted bank account, the sting of unexpected expenses, or the frustration of not knowing where your money went? We've all been there. Understanding the concept of "spent" is crucial for navigating the financial landscape and achieving our monetary goals. This article delves into the multifaceted world of "spent," exploring its origins, implications, and most importantly, how to harness its power for financial well-being.

The word "spent" is more than just a past tense verb. It represents the outflow of resources, a transaction completed, and a step towards acquiring goods, services, or experiences. From the smallest daily purchases to major investments, every instance of "spending" plays a role in shaping our financial trajectory. By understanding the nuances of this five-letter word, we can gain a deeper understanding of our relationship with money.

The concept of spending is as old as currency itself. From bartering goods in ancient civilizations to the complex digital transactions of today, the act of exchanging resources has been a cornerstone of human interaction. The evolution of spending reflects the changing economic landscape, highlighting the shift from tangible assets to digital currencies and the increasing interconnectedness of global finance.

The significance of "spent" in modern society cannot be overstated. It drives economies, fuels innovation, and shapes individual lifestyles. Understanding spending patterns is crucial for businesses to develop effective marketing strategies, governments to implement economic policies, and individuals to make informed financial decisions. The careful management of spent resources is the key to financial security and long-term prosperity.

However, the concept of "spent" is not without its challenges. Overspending, impulsive purchases, and a lack of financial literacy can lead to debt, stress, and financial instability. Recognizing these potential pitfalls is the first step towards taking control of our finances and building a secure financial future.

In its simplest form, "spent" means having used up or paid out money or resources. For example, "I spent $20 on groceries." or "She spent hours working on the project." The word emphasizes the completion of a transaction and the depletion of resources.

Understanding how money is spent can provide several benefits. First, it helps in budgeting and tracking expenses. Second, it allows for better financial planning and goal setting. Third, it promotes awareness of spending habits, which can lead to more mindful and responsible financial decisions.

Creating an action plan for managing expenditures begins with tracking your spending. Use a budgeting app, spreadsheet, or even a notebook to monitor your outflow. Next, categorize your spending and identify areas where you can cut back. Finally, set realistic financial goals and develop a savings plan.

Advantages and Disadvantages of Tracking "Spent" Resources

| Advantages | Disadvantages |

|---|---|

| Better budgeting and financial control | Time-consuming to track every expense |

| Increased awareness of spending habits | Potential for over-analysis and stress |

| Improved financial planning and goal setting | Requires discipline and consistency |

Best Practices for Managing "Spent" Resources:

1. Track your expenses: Monitor where your money goes.

2. Create a budget: Plan your spending and stick to it.

3. Set financial goals: Define your short-term and long-term objectives.

4. Automate savings: Regularly transfer a fixed amount to your savings account.

5. Review and adjust: Periodically evaluate your spending and make necessary changes.

FAQ:

1. What does "spent" mean? It means having used up or paid out money or resources.

2. Why is tracking spending important? It helps manage finances effectively.

3. How can I track my spending? Use budgeting apps, spreadsheets, or notebooks.

4. What are some common spending pitfalls? Impulsive purchases and overspending.

5. How can I avoid overspending? Create a budget and stick to it.

6. What are some benefits of saving money? Financial security and achieving financial goals.

7. How can I set financial goals? Define specific, measurable, achievable, relevant, and time-bound objectives.

8. Where can I find more information about personal finance? Consult reputable financial websites, books, or advisors.

In conclusion, "spent" is a powerful concept that shapes our financial lives. While it can be associated with challenges such as overspending and debt, understanding and managing our "spent" resources is crucial for financial well-being. By implementing effective strategies like budgeting, tracking expenses, and setting clear financial goals, we can harness the power of "spent" to build a secure and prosperous future. Take control of your finances today, start tracking your spending, and pave the way towards a brighter financial tomorrow. Don't let your money manage you; manage your money. Start now, and experience the positive impact of mindful spending on your life.

Five Letter Word Starts A Ends Y | Taqueria Autentica

five letter word with en in the middle | Taqueria Autentica

five letter word with en in the middle | Taqueria Autentica

5 Letter Words with T in the Middle 700 English Words | Taqueria Autentica

Five Letter Words That End In R N | Taqueria Autentica

5 Letter Words with I In The Middle 1100 Words in English | Taqueria Autentica

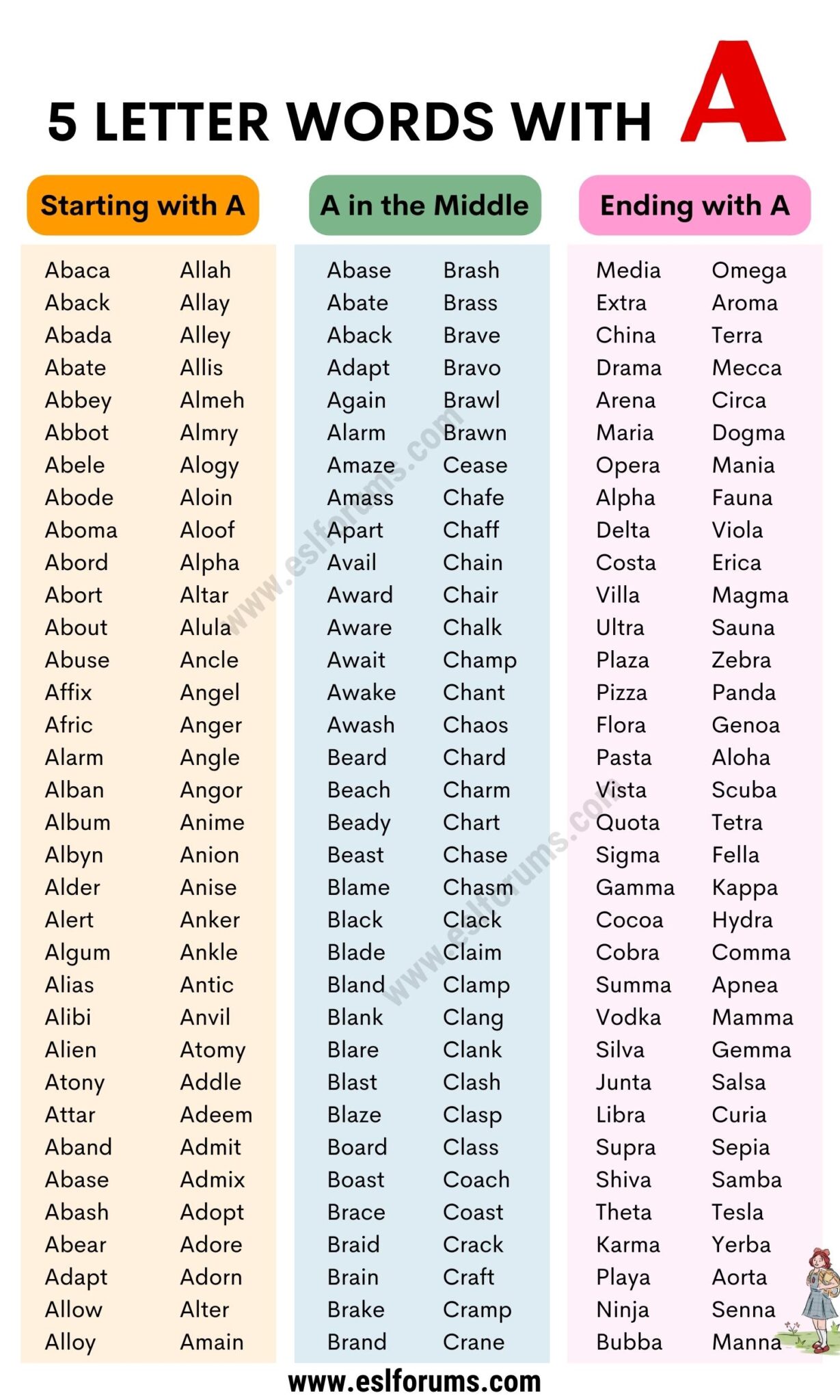

5 Letter Words with A | Taqueria Autentica

A Nice List of 840 Common 5 Letter Words with G | Taqueria Autentica

5 Letter Words with L 3000 English Words | Taqueria Autentica

5 Letter Words With Toa | Taqueria Autentica

Five Letter Word Starts Ta Ends Y | Taqueria Autentica

Five Letter Words That End In R N | Taqueria Autentica

5 Letter Word With E And N | Taqueria Autentica

Five Letter Words That Start With Sh | Taqueria Autentica

Five Letter Word With A Lt In The Middle | Taqueria Autentica