Unlocking Your Finances: A Comprehensive Guide to Bank of America Checking Accounts

Are you looking for a reliable and convenient way to manage your money? In today's fast-paced world, having a checking account is essential for handling everyday financial transactions. This guide delves deep into the world of Bank of America checking accounts, offering valuable insights and practical advice to help you navigate your finances effectively.

A Bank of America checking account can serve as the central hub for your financial activities, allowing you to deposit paychecks, pay bills, make purchases, and access your funds easily. Choosing the right checking account can significantly impact your financial well-being, so understanding the various options, fees, and benefits is crucial. This article aims to equip you with the knowledge you need to make informed decisions about your banking needs.

Bank of America offers a range of checking account options, each designed to cater to different financial profiles and preferences. From basic accounts for everyday transactions to premium accounts with added perks, you're likely to find an account that aligns with your specific needs. This guide will explore the different types of Bank of America checking accounts available, highlighting their key features and benefits.

Beyond the basics of depositing and withdrawing money, Bank of America checking accounts provide access to a suite of financial tools and services. These include online banking, mobile banking, bill pay, ATM access, and more. Leveraging these features can streamline your financial management and empower you to take control of your money.

Before diving into the specifics of Bank of America checking accounts, it's essential to understand the broader context of checking accounts in general. A checking account is a deposit account held at a financial institution that allows you to deposit and withdraw funds on demand. It's designed for frequent transactions and provides a convenient way to manage your day-to-day finances. Now, let's explore the specific offerings of Bank of America checking accounts in more detail.

Bank of America, established in 1904 (originally Bank of Italy), has a long history of providing financial services. Checking accounts became a cornerstone offering, evolving with technological advancements. The importance of a BofA checking account lies in its convenience, facilitating various transactions. Main issues historically include fees and account minimums.

Different Bank of America accounts offer features like mobile check deposit, overdraft protection, and debit card rewards. For instance, the Advantage SafeBalance Banking® option helps avoid overdraft fees.

Benefits include: 1) Convenient access to funds through ATMs and online banking. 2) Secure management of your finances. 3) Potential to earn rewards or interest.

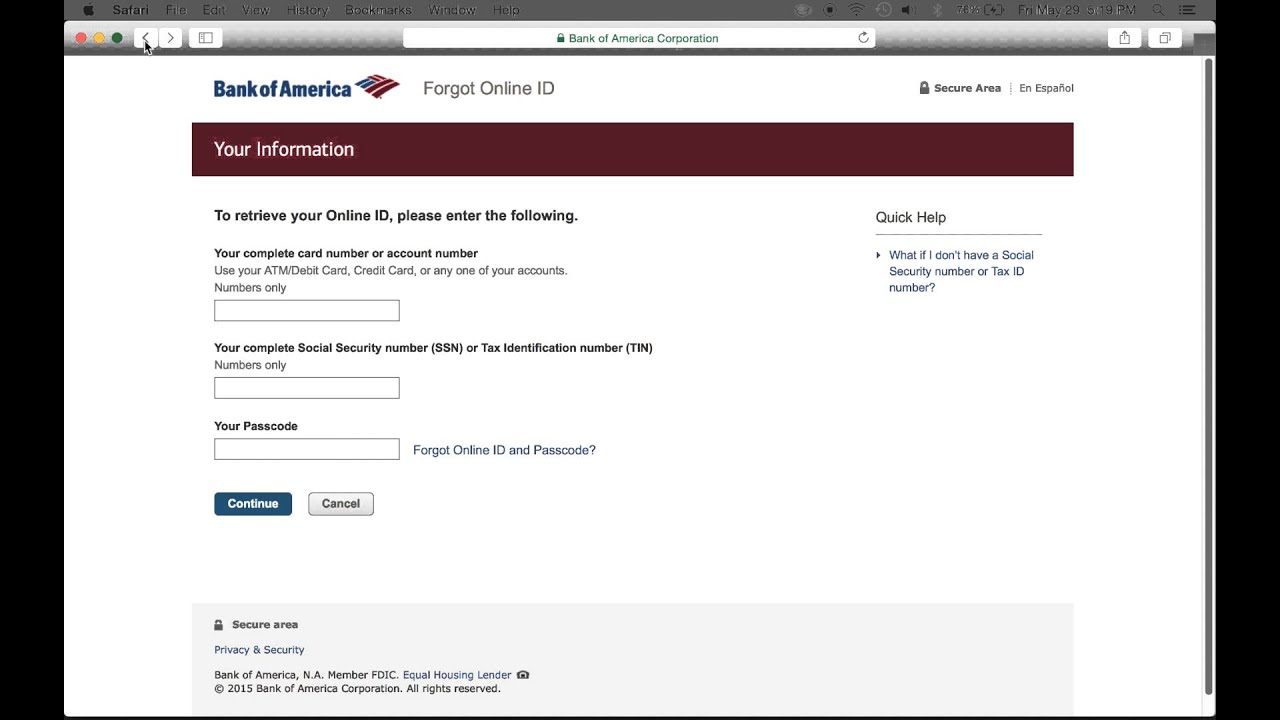

To open a BofA account: 1) Gather necessary documents (ID, SSN). 2) Choose the account type. 3) Apply online or in person. Successful examples include streamlining budgeting through online banking.

Checklist: Verify ID, compare account types, understand fees.

Step-by-step guide: Visit the BofA website, select “Checking,” choose an account, apply.

Recommendations: BofA website, mobile app.

Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Large ATM network | Potential monthly fees |

| Robust online banking | Minimum balance requirements on some accounts |

Best Practices: 1) Monitor your account regularly. 2) Set up account alerts. 3) Utilize online bill pay. 4) Explore available rewards programs. 5) Contact customer service for any issues.

Examples: 1) Direct deposit of paycheck. 2) Paying bills online. 3) Using mobile check deposit. 4) Transferring funds between accounts. 5) Setting up recurring payments.

Challenges: 1) Overdraft fees (Solution: Overdraft protection). 2) Lost or stolen debit card (Solution: Report immediately). 3) Difficulty navigating online banking (Solution: Contact customer service). 4) Maintaining minimum balance (Solution: Choose appropriate account). 5) Unauthorized transactions (Solution: Monitor account and report suspicious activity).

FAQ: 1) What are the different BofA checking accounts? 2) What are the fees? 3) How do I open an account? 4) How do I access online banking? 5) What are the ATM fees? 6) What is overdraft protection? 7) How do I deposit a check? 8) How do I contact customer service?

Tips: Utilize budgeting tools, set up direct deposit, explore available rewards.

In conclusion, choosing the right checking account is a vital step in managing your finances effectively. Bank of America offers a variety of checking accounts to meet diverse needs, each with its own set of features and benefits. From convenient online banking and mobile access to potential rewards programs, Bank of America checking accounts provide the tools necessary for efficient financial management. By understanding the different account types, fees, and best practices outlined in this guide, you can make informed decisions and take control of your financial well-being. We encourage you to explore the available options and choose the Bank of America checking account that best suits your individual financial goals. Don't wait – start maximizing your financial potential today by visiting the Bank of America website or contacting a local branch to learn more about the checking accounts they offer.

How To Read A Bank Statement | Taqueria Autentica

bank of america checking | Taqueria Autentica

How To Open a Bank of America Checking Account | Taqueria Autentica

Download Bank of America Direct Deposit Form | Taqueria Autentica

bank of america checking | Taqueria Autentica

Bank of america online | Taqueria Autentica

Editable Bank Of America Bank Statement Template | Taqueria Autentica

Will Bank Of America Cash My Check If I Dont Have An Account at Arthur | Taqueria Autentica

Premier Bank Routing Number Michigan at George Askew blog | Taqueria Autentica

Show Me Usa Number at Tracy Washington blog | Taqueria Autentica

Bank Of America Business Account Wire Fees | Taqueria Autentica

Resultado de imagen para bank of america usa cashiers check samples | Taqueria Autentica

Benefits of Having a Checking Account | Taqueria Autentica

How to Fill out a Checking Deposit Slip 12 Steps with Pictures | Taqueria Autentica

Bank of America Bank Statement Personal Checking Account | Taqueria Autentica