Unmasking Accrual Accounting: Why GAAP Prefers This Method

Ever wondered how businesses keep track of their finances and make informed decisions? It's not as simple as counting cash in hand. Under Generally Accepted Accounting Principles (GAAP), the accrual system is the gold standard for financial reporting. But what exactly makes this method so special?

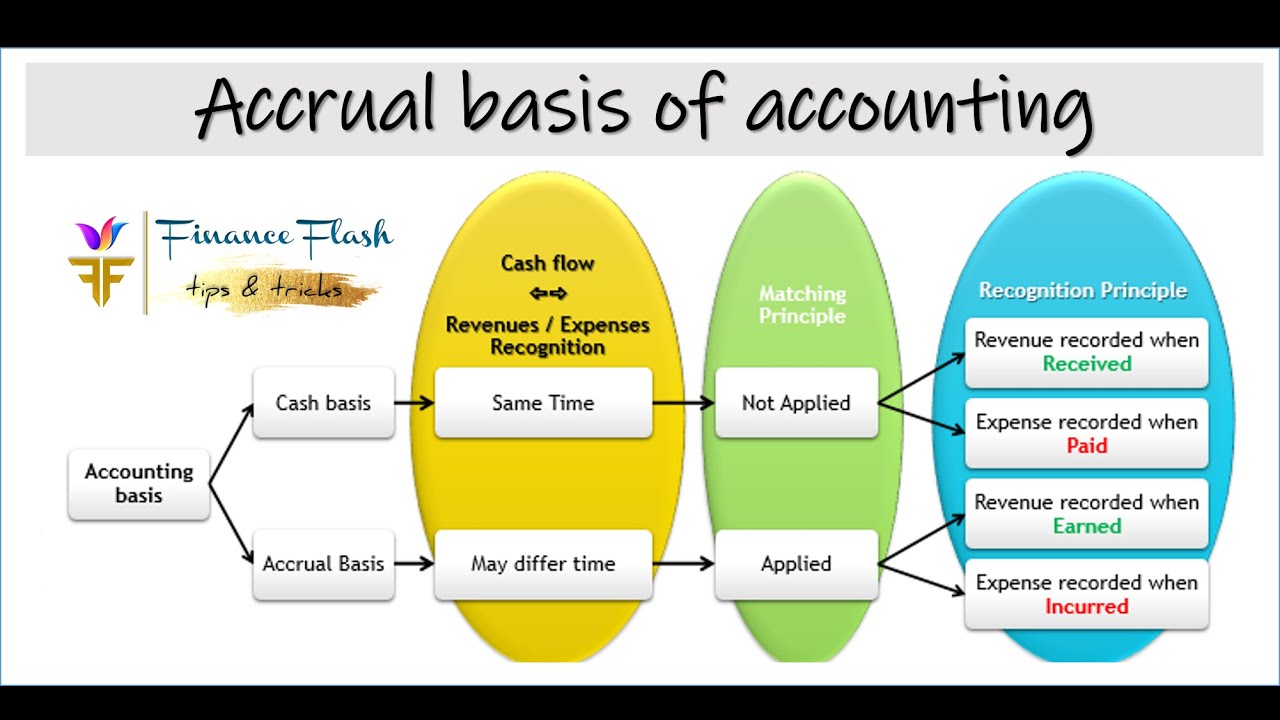

Imagine this: a company makes a big sale but hasn't received payment yet. In a cash-based system, this wouldn't be recorded until the money arrives. However, under the accrual method, this sale, along with the associated expense of goods sold, is documented immediately, even if the cash flow happens later. This paints a more accurate picture of the company's financial health, reflecting both the resources it uses and the revenue it generates in real-time.

This forward-thinking approach is a cornerstone of GAAP, ensuring financial statements provide a comprehensive view of a company's performance. By recognizing economic events when they occur, regardless of cash movement, accrual accounting allows for better decision-making, improved financial planning, and a clearer understanding of a company's profitability and financial position.

However, transitioning to an accrual system can present challenges. Companies need to establish rigorous internal controls, ensure accurate data entry, and provide adequate training to their staff. But the benefits, including a clearer picture of financial health, improved comparability with competitors, and greater compliance with regulatory requirements, far outweigh the initial hurdles.

In the following sections, we'll delve deeper into accrual accounting under GAAP, exploring its nuances, advantages, and how it contributes to transparent and reliable financial reporting. Whether you're a seasoned business owner or new to the world of finance, understanding accrual accounting is crucial for navigating the complexities of financial reporting.

Advantages and Disadvantages of Accrual Accounting

While accrual accounting under GAAP is the preferred method for financial reporting, it's essential to understand its strengths and weaknesses:

| Advantages | Disadvantages |

|---|---|

| Provides a more accurate picture of a company's profitability | Can be complex to implement and maintain |

| Offers a better understanding of long-term financial health | Requires more detailed record-keeping |

| Facilitates better financial planning and decision-making | May not reflect immediate cash flow situation |

| Ensures compliance with GAAP and other regulations |

In conclusion, understanding accrual accounting under GAAP is vital for anyone involved in business and finance. It provides a transparent and accurate lens through which to view a company's financial performance and make informed decisions. While it may pose some initial challenges, the long-term benefits of improved financial management, enhanced comparability, and greater compliance far outweigh the costs. By embracing accrual accounting, businesses can navigate the complexities of the financial world with confidence and clarity.

AnswerGAAP (US Generally Accepted Accounting Principles) is the acc.pdf | Taqueria Autentica

Answered: 15. Accrual accounting adheres to which | Taqueria Autentica

Accounting Principles, Ninth Edition | Taqueria Autentica

Chapter 3: Reporting Operating Results on the Income Statement Learning | Taqueria Autentica

under gaap the accrual system is used | Taqueria Autentica

Generally accepted accounting principle GAAP | Taqueria Autentica

VIDEO solution: 4. Selected transactional data of a business are | Taqueria Autentica

Answered: Based on the following information, | Taqueria Autentica

Read Accounting Principles Made Simple:The Ultimate Beginner's Guide to | Taqueria Autentica

under gaap the accrual system is used | Taqueria Autentica

under gaap the accrual system is used | Taqueria Autentica

under gaap the accrual system is used | Taqueria Autentica

What Is Modified Accrual Accounting | Taqueria Autentica

under gaap the accrual system is used | Taqueria Autentica

Answered: Which of the following is not a | Taqueria Autentica