Unveiling the Mystery: What is 'No Pengenalan Cukai'?

Have you ever been caught in a whirlwind of bureaucratic jargon, struggling to decipher official documents or websites? Then you've likely encountered cryptic phrases that seem to belong to a secret code. One such enigmatic term is "No Pengenalan Cukai." What does it mean, and why is it important? Let's embark on a journey to demystify this phrase and uncover its hidden significance.

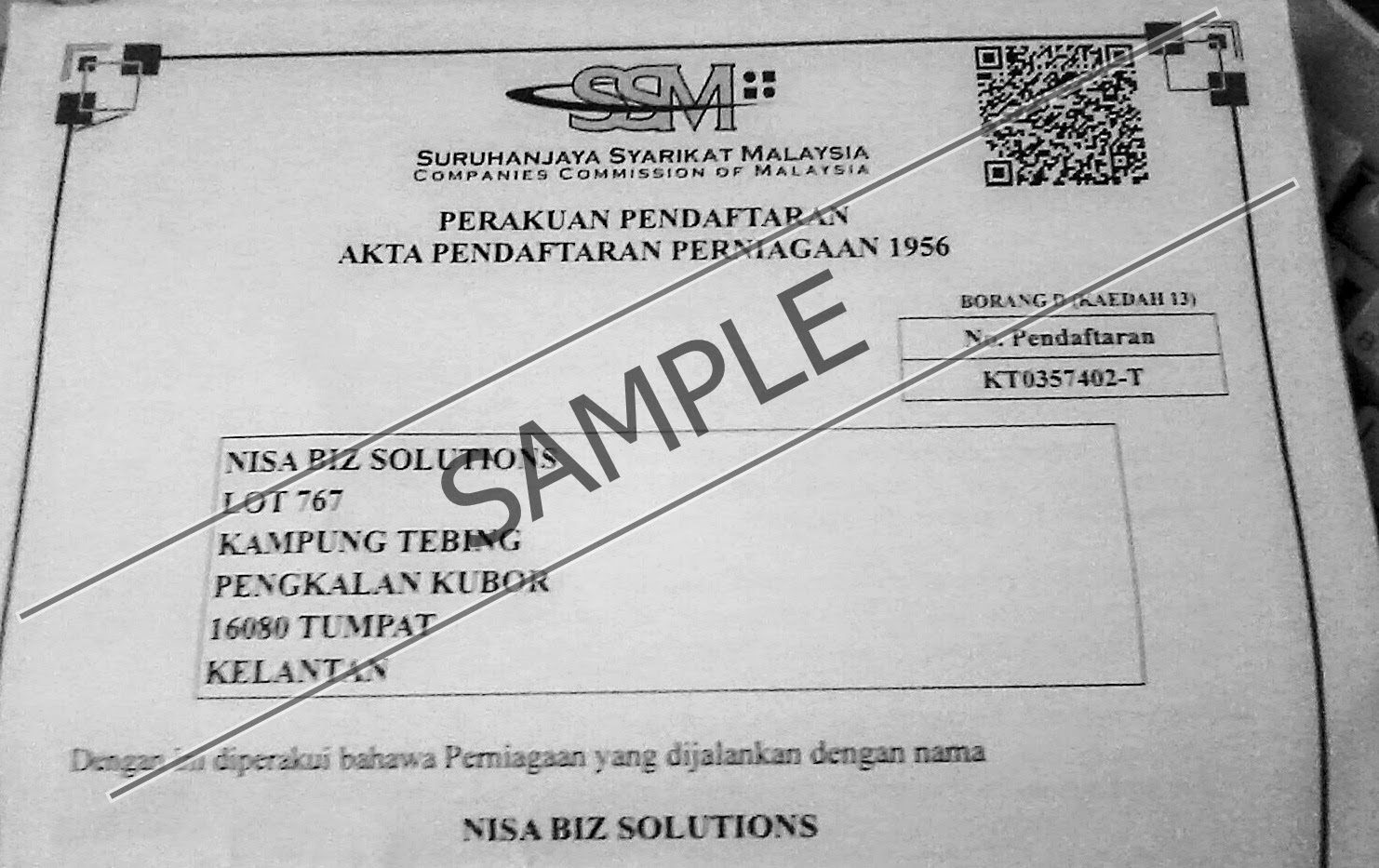

"No Pengenalan Cukai" is a Malay term that directly translates to "Tax Identification Number" in English. Just like a social security number in the United States or a National Identification Number in other countries, it serves as a unique identifier within the realm of taxation. This number is the key that unlocks your tax profile and enables the government to track your financial activities for tax purposes.

Imagine a vast library filled with financial records of every individual and business in a country. Without a system for organization, chaos would ensue. That's where the "No Pengenalan Cukai" comes into play. It acts as a digital fingerprint, allowing tax authorities to efficiently categorize and manage tax-related information.

The history and origins of tax identification numbers can be traced back to ancient civilizations that recognized the need for organized systems of revenue collection. As societies evolved and economies grew more complex, so did the methods of taxation and the need for accurate identification of taxpayers. The introduction of computerized systems revolutionized tax administration, making unique identification numbers essential for efficient data management and processing.

The importance of the "No Pengenalan Cukai" cannot be overstated. It forms the bedrock of a fair and transparent tax system. Without it, individuals and businesses could easily evade their tax obligations, leading to revenue loss for the government and an uneven playing field for those who comply with tax laws.

While the concept of a tax identification number is relatively straightforward, the complexities arise in its implementation and the challenges associated with ensuring its accuracy and security. Issues such as identity theft, data breaches, and the informal economy pose significant hurdles to maintaining the integrity of tax identification systems.

Advantages and Disadvantages of a Strong Tax Identification System

| Advantages | Disadvantages |

|---|---|

| Increased tax revenue for government services | Potential for privacy violations if data is not properly secured |

| Fairer distribution of tax burden | Complexity and administrative burden on individuals and businesses |

| Improved tax compliance and reduced tax evasion | Possibility of errors or inaccuracies in tax records |

Understanding the importance of the "No Pengenalan Cukai" is crucial for anyone navigating the financial landscape. It's a fundamental element of modern tax systems, ensuring accountability, transparency, and the efficient functioning of government services. As we move towards an increasingly digital world, the significance of secure and reliable tax identification systems will only continue to grow.

what is no pengenalan cukai | Taqueria Autentica

How to Pay Income Tax (LHDN) Online? | Taqueria Autentica

what is no pengenalan cukai | Taqueria Autentica

Carian mengenai topik nombor | Taqueria Autentica

5 Ways to Check Outstanding Income Tax Malaysia via MyTax Hasil | Taqueria Autentica

what is no pengenalan cukai | Taqueria Autentica

what is no pengenalan cukai | Taqueria Autentica

what is no pengenalan cukai | Taqueria Autentica

what is no pengenalan cukai | Taqueria Autentica

what is no pengenalan cukai | Taqueria Autentica

what is no pengenalan cukai | Taqueria Autentica

what is no pengenalan cukai | Taqueria Autentica

Contoh Nombor Lesen Perniagaan at Cermati | Taqueria Autentica

what is no pengenalan cukai | Taqueria Autentica

Berita baik... Ibu bapa ada anak OKU boleh mohon road tax free! Jom | Taqueria Autentica